Instructions For Form Llc-9 - Completing The Certificate Of Merger

ADVERTISEMENT

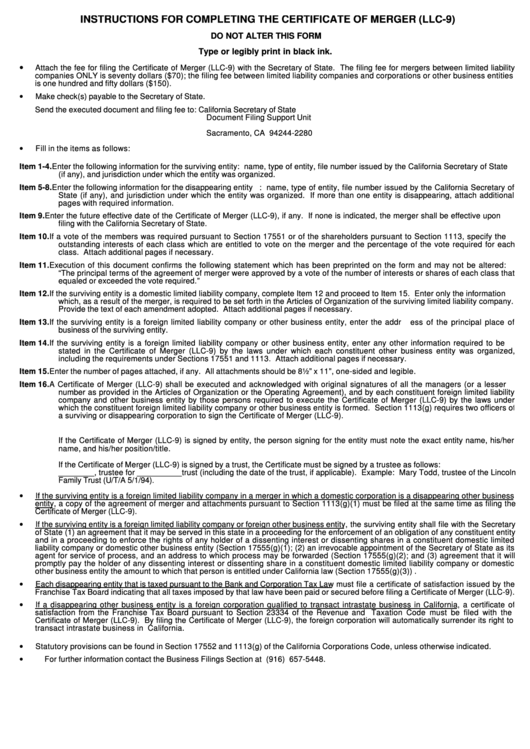

INSTRUCTIONS FOR COMPLETING THE CERTIFICATE OF MERGER (LLC-9)

DO NOT ALTER THIS FORM

Type or legibly print in black ink.

•

Attach the fee for filing the Certificate of Merger (LLC-9) with the Secretary of State. The filing fee for mergers between limited liability

companies ONLY is seventy dollars ($70); the filing fee between limited liability companies and corporations or other business entities

is one hundred and fifty dollars ($150).

•

Make check(s) payable to the Secretary of State.

Send the executed document and filing fee to:

California Secretary of State

Document Filing Support Unit

P.O. Box 944228

Sacramento, CA 94244-2280

•

Fill in the items as follows:

Item 1-4. Enter the following information for the surviving entity: name, type of entity, file number issued by the California Secretary of State

(if any), and jurisdiction under which the entity was organized.

Item 5-8. Enter the following information for the disappearing entity: name, type of entity, file number issued by the California Secretary of

State (if any), and jurisdiction under which the entity was organized. If more than one entity is disappearing, attach additional

pages with required information.

Item 9.

Enter the future effective date of the Certificate of Merger (LLC-9), if any. If none is indicated, the merger shall be effective upon

filing with the California Secretary of State.

Item 10.

If a vote of the members was required pursuant to Section 17551 or of the shareholders pursuant to Section 1113, specify the

outstanding interests of each class which are entitled to vote on the merger and the percentage of the vote required for each

class. Attach additional pages if necessary.

Item 11.

Execution of this document confirms the following statement which has been preprinted on the form and may not be altered:

“The principal terms of the agreement of merger were approved by a vote of the number of interests or shares of each class that

equaled or exceeded the vote required.”

Item 12.

If the surviving entity is a domestic limited liability company, complete Item 12 and proceed to Item 15. Enter only the information

which, as a result of the merger, is required to be set forth in the Articles of Organization of the surviving limited liability company.

Provide the text of each amendment adopted. Attach additional pages if necessary.

Item 13.

If the surviving entity is a foreign limited liability company or other business entity, enter the address of the principal place of

business of the surviving entity.

Item 14.

If the surviving entity is a foreign limited liability company or other business entity, enter any other information required to be

stated in the Certificate of Merger (LLC-9) by the laws under which each constituent other business entity was organized,

including the requirements under Sections 17551 and 1113. Attach additional pages if necessary.

Item 15.

Enter the number of pages attached, if any. All attachments should be 8½” x 11”, one-sided and legible.

Item 16.

A Certificate of Merger (LLC-9) shall be executed and acknowledged with original signatures of all the managers (or a lesser

number as provided in the Articles of Organization or the Operating Agreement), and by each constituent foreign limited liability

company and other business entity by those persons required to execute the Certificate of Merger (LLC-9) by the laws under

which the constituent foreign limited liability company or other business entity is formed. Section 1113(g) requires two officers of

a surviving or disappearing corporation to sign the Certificate of Merger (LLC-9).

If the Certificate of Merger (LLC-9) is signed by entity, the person signing for the entity must note the exact entity name, his/her

name, and his/her position/title.

If the Certificate of Merger (LLC-9) is signed by a trust, the Certificate must be signed by a trustee as follows:

________, trustee for __________trust (including the date of the trust, if applicable). Example: Mary Todd, trustee of the Lincoln

Family Trust (U/T/A 5/1/94).

•

If the surviving entity is a foreign limited liability company in a merger in which a domestic corporation is a disappearing other business

entity, a copy of the agreement of merger and attachments pursuant to Section 1113(g)(1) must be filed at the same time as filing the

Certificate of Merger (LLC-9).

•

If the surviving entity is a foreign limited liability company or foreign other business entity, the surviving entity shall file with the Secretary

of State (1) an agreement that it may be served in this state in a proceeding for the enforcement of an obligation of any constituent entity

and in a proceeding to enforce the rights of any holder of a dissenting interest or dissenting shares in a constituent domestic limited

liability company or domestic other business entity (Section 17555(g)(1); (2) an irrevocable appointment of the Secretary of State as its

agent for service of process, and an address to which process may be forwarded (Section 17555(g)(2); and (3) agreement that it will

promptly pay the holder of any dissenting interest or dissenting share in a constituent domestic limited liability company or domestic

other business entity the amount to which that person is entitled under California law (Section 17555(g)(3)) .

•

Each disappearing entity that is taxed pursuant to the Bank and Corporation Tax Law must file a certificate of satisfaction issued by the

Franchise Tax Board indicating that all taxes imposed by that law have been paid or secured before filing a Certificate of Merger (LLC-9).

•

If a disappearing other business entity is a foreign corporation qualified to transact intrastate business in California, a certificate of

satisfaction from the Franchise Tax Board pursuant to Section 23334 of the Revenue and Taxation Code must be filed with the

Certificate of Merger (LLC-9). By filing the Certificate of Merger (LLC-9), the foreign corporation will automatically surrender its right to

transact intrastate business in California.

•

Statutory provisions can be found in Section 17552 and 1113(g) of the California Corporations Code, unless otherwise indicated.

•

For further information contact the Business Filings Section at (916) 657-5448.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1