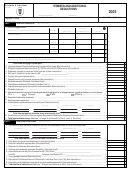

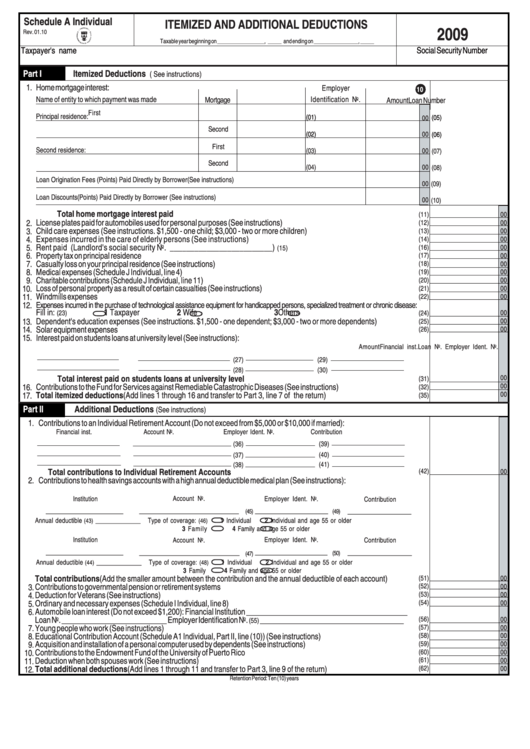

Schedule A Individual - Itemized And Additional Deductions - 2009

ADVERTISEMENT

Schedule A Individual

ITEMIZED AND ADDITIONAL DEDUCTIONS

2009

Rev. 01.10

Taxable year beginning on _________________, _____ and ending on ________________, _____

Taxpayer's name

Social Security Number

Part I

Itemized Deductions

( See instructions)

1.

Home mortgage interest:

Employer

10

Name of entity to which payment was made

Identification No.

Mortgage

Loan Number

Amount

First

Principal residence:

(01)

(05)

00

Second

(02)

00

(06)

First

Second residence:

(03)

00

(07)

Second

(04)

00

(08)

Loan Origination Fees (Points) Paid Directly by Borrower (See instructions)

00

(09)

Loan Discounts (Points) Paid Directly by Borrower (See instructions)

00

(10)

Total home mortgage interest paid ......................................................................................................................

(11)

00

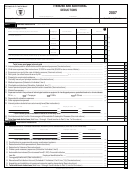

License plates paid for automobiles used for personal purposes (See instructions) ...............................................................

2.

(12)

00

Child care expenses (See instructions. $1,500 - one child; $3,000 - two or more children) ..................................................

3.

(13)

00

4.

Expenses incurred in the care of elderly persons (See instructions) .........................................................................

(14)

00

5.

Rent paid (Landlord's social security No. _________________________)

.......................................................

(16)

00

(15)

Property tax on principal residence ......................................................................................................................................

6.

(17)

00

Casualty loss on your principal residence (See instructions) .................................................................................................

7.

(18)

00

8.

Medical expenses (Schedule J Individual, line 4) .................................................................................................................

(19)

00

9.

Charitable contributions (Schedule J Individual, line 11) .......................................................................................................

(20)

00

Loss of personal property as a result of certain casualties (See instructions) .........................................................................

10.

(21)

00

Windmills expenses ..............................................................................................................................................................

11.

(22)

00

12.

Expenses incurred in the purchase of technological assistance equipment for handicapped persons, specialized treatment or chronic disease:

Fill in:

1 Taxpayer

2 Wife

3 Others .......................................

(24)

00

(23)

Dependent's education expenses (See instructions. $1,500 - one dependent; $3,000 - two or more dependents) ...............

13.

(25)

00

Solar equipment expenses ...................................................................................................................................................

14.

00

(26)

15.

Interest paid on students loans at university level (See instructions):

Financial inst.

Loan No.

Employer Ident. No.

Amount

(27)

(29)

(30)

(28)

Total interest paid on students loans at university level .................................................................................

00

(31)

Contributions to the Fund for Services against Remediable Catastrophic Diseases (See instructions) ...................................

00

16.

(32)

Total itemized deductions (Add lines 1 through 16 and transfer to Part 3, line 7 of the return) ........................................

00

17.

(35)

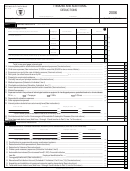

Part II

Additional Deductions

(See instructions)

1.

Contributions to an Individual Retirement Account (Do not exceed from $5,000 or $10,000 if married):

Financial inst.

Account No.

Employer Ident. No.

Contribution

(39)

(36)

(40)

(37)

(41)

(38)

Total contributions to Individual Retirement Accounts ........................................................................................

(42)

00

2.

Contributions to health savings accounts with a high annual deductible medical plan (See instructions):

Institution

Account No.

Employer Ident. No.

Contribution

______________________________

______________________________

__________________________

_________________________

(45)

(49)

Annual deductible

______________

Type of coverage:

1 Individual

2 Individual and age 55 or older

(43)

(46)

3 Family

4 Family and age 55 or older

Institution

Employer Ident. No.

Account No.

Contribution

______________________________

__________________________

______________________________

_________________________

(50)

(47)

Annual deductible

______________

Type of coverage:

1 Individual

2 Individual and age 55 or older

(44)

(48)

3 Family

4 Family and age 55 or older

Total contributions (Add the smaller amount between the contribution and the annual deductible of each account) .........

(51)

00

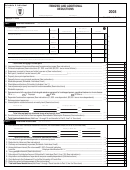

Contributions to governmental pension or retirement systems ..............................................................................................

3.

(52)

00

Deduction for Veterans (See instructions) ............................................................................................................................

4.

(53)

00

5.

Ordinary and necessary expenses (Schedule I Individual, line 8) .........................................................................................

(54)

00

6.

Automobile loan interest (Do not exceed $1,200): Financial Institution _________________________________________

Loan No. ___________________________ Employer Identification No.

_____________________________________

(56)

00

(55)

Young people who work (See instructions) .........................................................................................................................

7.

(57)

00

8.

Educational Contribution Account (Schedule A1 Individual, Part II, line (10)) (See instructions) ...........................................

(58)

00

9.

Acquisition and installation of a personal computer used by dependents (See instructions) ...................................................

(59)

00

Contributions to the Endowment Fund of the University of Puerto Rico .................................................................................

10.

(60)

00

Deduction when both spouses work (See instructions) ........................................................................................................

11.

(61)

00

12.

Total additional deductions (Add lines 1 through 11 and transfer to Part 3, line 9 of the return) .......................................

(62)

00

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1