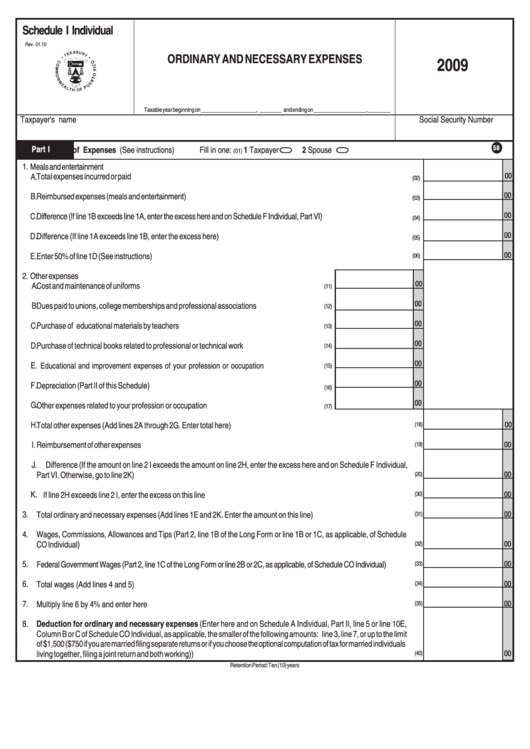

Schedule I Individual - Ordinary And Necessary Expenses - 2009

ADVERTISEMENT

Schedule I Individual

Rev. 01.10

ORDINARY AND NECESSARY EXPENSES

2009

Taxable year beginning on ____________________, ________ and ending on ___________________, ________

Taxpayer's name

Social Security Number

58

Part I

Detail of Expenses (See instructions)

Fill in one:

1 Taxpayer

2 Spouse

(01)

1.

Meals and entertainment

00

A.

Total expenses incurred or paid .........................................................................................................................................

(02)

00

B.

Reimbursed expenses (meals and entertainment) .............................................................................................................

(03)

00

C.

Difference (If line 1B exceeds line 1A, enter the excess here and on Schedule F Individual, Part VI) .........................................

(04)

00

D.

Difference (If line 1A exceeds line 1B, enter the excess here) ..........................................................................................

(05)

00

E.

Enter 50% of line 1D (See instructions) .............................................................................................................................

(06)

2.

Other expenses

00

A.

Cost and maintenance of uniforms ......................................................................................

(11)

00

B.

Dues paid to unions, college memberships and professional associations ...........................

(12)

00

C.

Purchase of educational materials by teachers ..................................................................

(13)

00

D.

Purchase of technical books related to professional or technical work .................................

(14)

00

E.

Educational and improvement expenses of your profession or occupation ............................

(15)

00

F.

Depreciation (Part II of this Schedule) .................................................................................

(16)

00

G.

Other expenses related to your profession or occupation ...................................................

(17)

H.

Total other expenses (Add lines 2A through 2G. Enter total here) ...................................................................................

00

(18)

I.

Reimbursement of other expenses ...................................................................................................................................

00

(19)

J.

Difference (If the amount on line 2 I exceeds the amount on line 2H, enter the excess here and on Schedule F Individual,

Part VI. Otherwise, go to line 2K) .....................................................................................................................................

00

(20)

K.

If line 2H exceeds line 2 I, enter the excess on this line ....................................................................................................

00

(30)

3.

00

Total ordinary and necessary expenses (Add lines 1E and 2K. Enter the amount on this line) .............................................

(31)

4.

Wages, Commissions, Allowances and Tips (Part 2, line 1B of the Long Form or line 1B or 1C, as applicable, of Schedule

CO Individual) ......................................................................................................................................................................

00

(32)

5.

Federal Government Wages (Part 2, line 1C of the Long Form or line 2B or 2C, as applicable, of Schedule CO Individual) ........

00

(33)

6.

Total wages (Add lines 4 and 5) ...........................................................................................................................................

00

(34)

7.

Multiply line 6 by 4% and enter here ....................................................................................................................................

00

(35)

8.

Deduction for ordinary and necessary expenses (Enter here and on Schedule A Individual, Part II, line 5 or line 10E,

Column B or C of Schedule CO Individual, as applicable, the smaller of the following amounts: line 3, line 7, or up to the limit

of $1,500 ($750 if you are married filing separate returns or if you choose the optional computation of tax for married individuals

living together, filing a joint return and both working)) ........................................................................................................

00

(40)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2