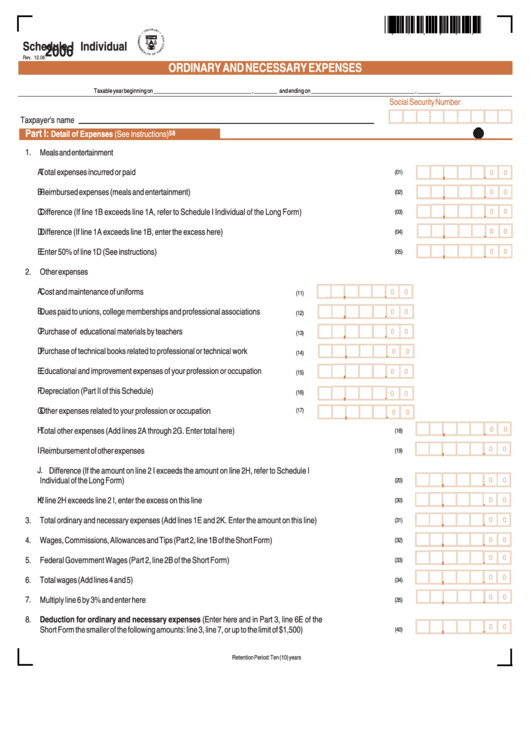

Schedule I Individual - Ordinary And Necessary Expenses - 2006

ADVERTISEMENT

E

I

0

6

0

0

Schedule I Individual

2006

Rev. 12.06

ORDINARY AND NECESSARY EXPENSES

Taxable year beginning on __________________________________ , ________ and ending on ____________________________________ , ________

Social Security Number

Taxpayer's name

Part I:

Detail of Expenses (See instructions)

58

1.

Meals and entertainment

A.

Total expenses incurred or paid ............................................................................................................................

(01)

.

0

0

,

B.

Reimbursed expenses (meals and entertainment) ................................................................................................

(02)

.

0

0

,

C.

Difference (If line 1B exceeds line 1A, refer to Schedule I Individual of the Long Form) .....................................

(03)

.

0

0

,

D.

Difference (If line 1A exceeds line 1B, enter the excess here) ...............................................................................

(04)

.

0

0

,

E.

Enter 50% of line 1D (See instructions) .................................................................................................................

(05)

.

0

0

,

2.

Other expenses

A.

Cost and maintenance of uniforms .......................................................................

.

0

0

(11)

,

B.

Dues paid to unions, college memberships and professional associations ...........

.

(12)

0

0

,

C.

Purchase of educational materials by teachers ...................................................

.

(13)

0

0

,

D.

Purchase of technical books related to professional or technical work .................

.

(14)

0

0

,

E.

Educational and improvement expenses of your profession or occupation ..........

.

0

0

(15)

,

F.

Depreciation (Part II of this Schedule) .................................................................

(16)

.

0

0

,

G.

Other expenses related to your profession or occupation ....................................

(17)

.

0

0

,

H.

Total other expenses (Add lines 2A through 2G. Enter total here) ..........................................................................

.

0

0

(18)

,

I.

Reimbursement of other expenses .........................................................................................................................

.

0

0

(19)

,

J.

Difference (If the amount on line 2 I exceeds the amount on line 2H, refer to Schedule I

Individual of the Long Form) ..................................................................................................................................

(20)

.

0

0

,

K.

If line 2H exceeds line 2 I, enter the excess on this line ...........................................................................................

(30)

.

0

0

,

3.

Total ordinary and necessary expenses (Add lines 1E and 2K. Enter the amount on this line) ...................................

(31)

.

0

0

,

4.

Wages, Commissions, Allowances and Tips (Part 2, line 1B of the Short Form)...........................................................

(32)

.

0

0

,

5.

Federal Government Wages (Part 2, line 2B of the Short Form) ..............................................................................

.

0

0

(33)

,

6.

.

Total wages (Add lines 4 and 5) .................................................................................................................................

0

0

(34)

,

.

0

0

7.

Multiply line 6 by 3% and enter here ..........................................................................................................................

,

(35)

8.

Deduction for ordinary and necessary expenses (Enter here and in Part 3, line 6E of the

.

0

0

Short Form the smaller of the following amounts: line 3, line 7, or up to the limit of $1,500) ..........................................

,

(40)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2