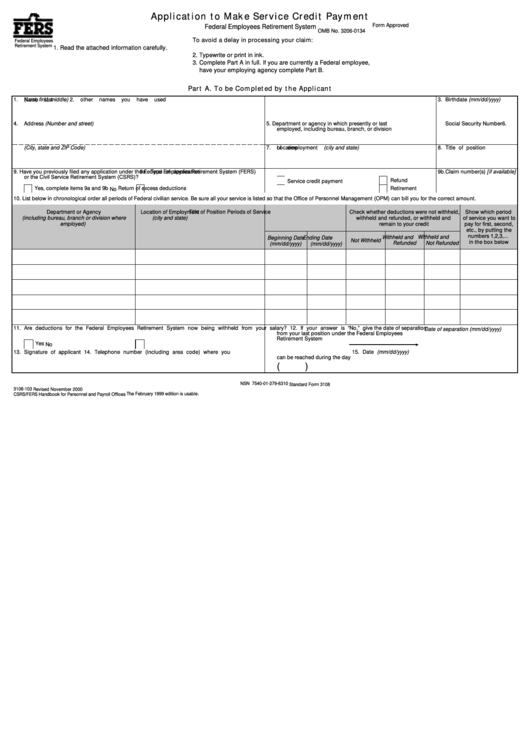

Application to Make Service Credit Payment

Form Approved

Federal Employees Retirement System

OMB No. 3206-0134

To avoid a delay in processing your claim:

Federal Employees

Retirement System

1. Read the attached information carefully.

2. Typewrite or print in ink.

3. Complete Part A in full. If you are currently a Federal employee,

have your employing agency complete Part B.

Part A. To be Completed by the Applicant

1.

Name

(Last, first, middle)

2.

List

other names you have used

3.

Birthdate (mm/dd/yyyy)

4.

Address (Number and street)

5.

Department or agency in which presently or last

6.

Social Security Number

employed, including bureau, branch, or division

(City, state and ZIP Code)

7.

Location

of employment (city and state)

8. Title of position

9.

Have you previously filed any application under the Federal Employees Retirement System (FERS)

9a. Type of application

9b.Claim number(s) [if available]

or the Civil Service Retirement System (CSRS)?

Refund

Service credit payment

Yes, complete items 9a and 9b

Return of excess deductions

Retirement

No

10. List below in chronological order all periods of Federal civilian service. Be sure all your service is listed so that the Office of Personnel Management (OPM) can bill you for the correct amount.

Department or Agency

Location of Employment

Title of Position

Periods of Service

Check whether deductions were not withheld,

Show which period

(including bureau, branch or division where

(city and state)

withheld and refunded, or withheld and

of service you want to

employed)

remain to your credit

pay for first, second,

etc., by putting the

numbers 1,2,3,...

Withheld and

Withheld and

Beginning Date

Ending Date

Not Withheld

in the box below

Refunded

Not Refunded

(mm/dd/yyyy)

(mm/dd/yyyy)

11. Are deductions for the Federal Employees Retirement System now being withheld from your salary? 12. If your answer is "No," give the date of separation

Date of separation (mm/dd/yyyy)

from your last position under the Federal Employees

Retirement System

Yes

No

13. Signature of applicant

14. Telephone number (including area code) where you

15. Date (mm/dd/yyyy)

can be reached during the day

(

)

NSN 7540-01-279-6310

Standard Form 3108

3108-103

Revised November 2000

U.S. Office of Personnel Management

The February 1999 edition is usable.

CSRS/FERS Handbook for Personnel and Payroll Offices

1

1 2

2