Tax Processing Sales Tax E-Filing Agreement For File Transmissions Form - State Of Wisconsin

ADVERTISEMENT

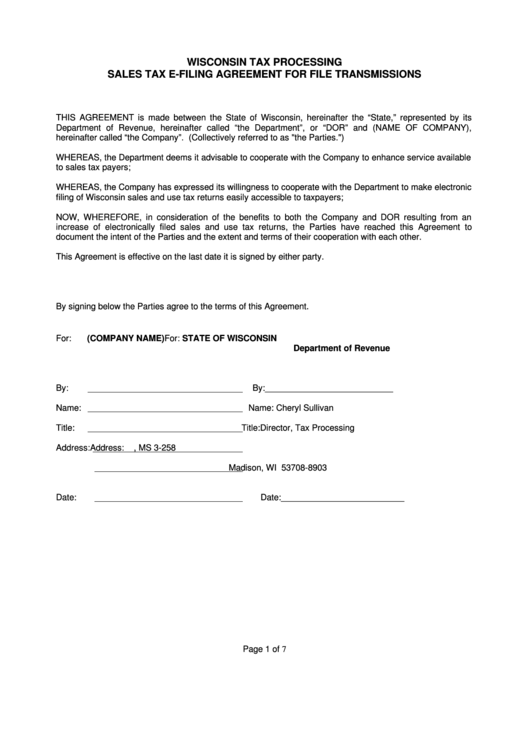

WISCONSIN TAX PROCESSING

SALES TAX E-FILING AGREEMENT FOR FILE TRANSMISSIONS

THIS AGREEMENT is made between the State of Wisconsin, hereinafter the “State,” represented by its

Department of Revenue, hereinafter called “the Department”, or “DOR” and (NAME OF COMPANY),

hereinafter called “the Company”. (Collectively referred to as "the Parties.")

WHEREAS, the Department deems it advisable to cooperate with the Company to enhance service available

to sales tax payers;

WHEREAS, the Company has expressed its willingness to cooperate with the Department to make electronic

filing of Wisconsin sales and use tax returns easily accessible to taxpayers;

NOW, WHEREFORE, in consideration of the benefits to both the Company and DOR resulting from an

increase of electronically filed sales and use tax returns, the Parties have reached this Agreement to

document the intent of the Parties and the extent and terms of their cooperation with each other.

This Agreement is effective on the last date it is signed by either party.

By signing below the Parties agree to the terms of this Agreement.

For:

(COMPANY NAME)

For:

STATE OF WISCONSIN

Department of Revenue

By:

By:___________________________

Name:

Name:

Cheryl Sullivan

Title:

Title:

Director, Tax Processing

Address:

Address: P.O. Box 8903, MS 3-258

Madison, WI 53708-8903

Date:

Date:__________________________

Page 1 of 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7