Form St-134 - Exemption Certificate For Construction Contractors Form - State Of Indiana

ADVERTISEMENT

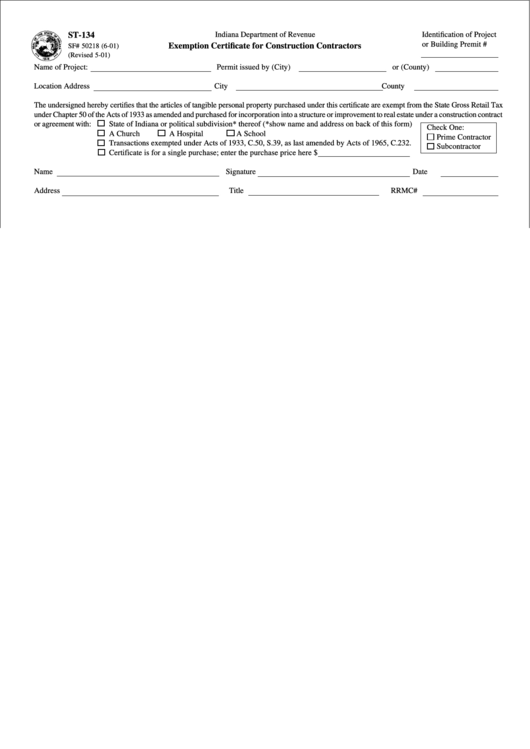

ST-134

Indiana Department of Revenue

Identification of Project

or Building Premit #

Exemption Certificate for Construction Contractors

SF# 50218 (6-01)

(Revised 5-01)

Name of Project:

Permit issued by (City)

or (County)

Location Address

City

County

The undersigned hereby certifies that the articles of tangible personal property purchased under this certificate are exempt from the State Gross Retail Tax

under Chapter 50 of the Acts of 1933 as amended and purchased for incorporation into a structure or improvement to real estate under a construction contract

or agreement with:

State of Indiana or political subdivision* thereof (*show name and address on back of this form)

Check One:

A Church

A Hospital

A School

Prime Contractor

Transactions exempted under Acts of 1933, C.50, S.39, as last amended by Acts of 1965, C.232.

Subcontractor

Certificate is for a single purchase; enter the purchase price here $

Name

Signature

Date

Address

Title

RRMC#

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1