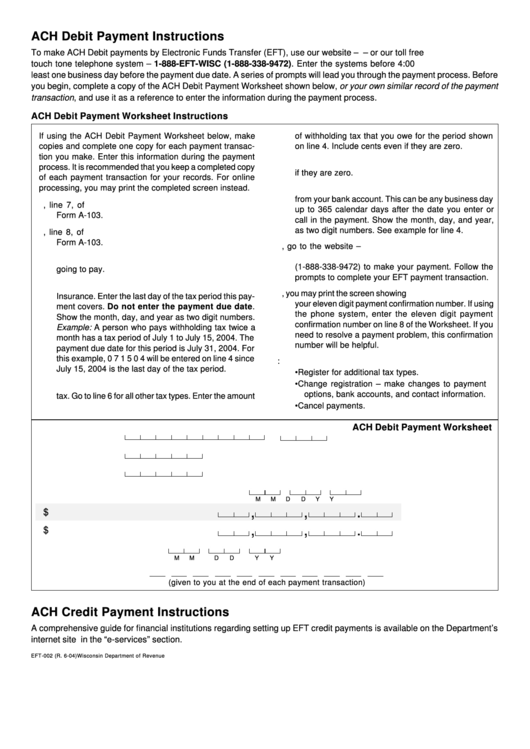

Ach Debit Payment Worksheet

ADVERTISEMENT

ACH Debit Payment Instructions

To make ACH Debit payments by Electronic Funds Transfer (EFT), use our website – – or our toll free

touch tone telephone system – 1-888-EFT-WISC (1-888-338-9472). Enter the systems before 4:00 p.m. Central Time at

least one business day before the payment due date. A series of prompts will lead you through the payment process. Before

you begin, complete a copy of the ACH Debit Payment Worksheet shown below, or your own similar record of the payment

transaction, and use it as a reference to enter the information during the payment process.

ACH Debit Payment Worksheet Instructions

If using the ACH Debit Payment Worksheet below, make

of withholding tax that you owe for the period shown

copies and complete one copy for each payment transac-

on line 4. Include cents even if they are zero.

tion you make. Enter this information during the payment

6. Enter the amount you want to pay. Include cents even

process. It is recommended that you keep a completed copy

if they are zero.

of each payment transaction for your records. For online

processing, you may print the completed screen instead.

7. Enter the date you want the payment to be transferred

from your bank account. This can be any business day

1. Enter your EFT Identifier from Section I, line 7, of

up to 365 calendar days after the date you enter or

Form A-103.

call in the payment. Show the month, day, and year,

as two digit numbers. See example for line 4.

2. Enter your EFT password from Section I, line 8, of

Form A-103.

8. After completing the Worksheet, go to the website –

or

call

1-888-EFT-WISC

3. Enter the five digit tax type code of the tax that you are

(1-888-338-9472) to make your payment. Follow the

going to pay.

prompts to complete your EFT payment transaction.

4. Complete for all tax types except Unemployment

9. For online payments, you may print the screen showing

Insurance. Enter the last day of the tax period this pay-

your eleven digit payment confirmation number. If using

ment covers. Do not enter the payment due date.

the phone system, enter the eleven digit payment

Show the month, day, and year as two digit numbers.

confirmation number on line 8 of the Worksheet. If you

Example: A person who pays withholding tax twice a

need to resolve a payment problem, this confirmation

month has a tax period of July 1 to July 15, 2004. The

number will be helpful.

payment due date for this period is July 31, 2004. For

this example, 0 7 1 5 0 4 will be entered on line 4 since

10. Other options offered on the EFT system are:

July 15, 2004 is the last day of the tax period.

• Register for additional tax types.

• Change registration – make changes to payment

5. Complete this line only if you are paying withholding

options, bank accounts, and contact information.

tax. Go to line 6 for all other tax types. Enter the amount

• Cancel payments.

ACH Debit Payment Worksheet

1. EFT Identifier

2. EFT Password

3. Tax Type Code

4. Last day of the Tax Period this payment covers

M

M

D

D

Y

Y

,

,

.

$

5. Amount of Withholding Tax you owe

,

,

.

$

6. Amount of this Tax Payment

7. Effective Date of Payment

M

M

D

D

Y

Y

8. Confirmation number

(given to you at the end of each payment transaction)

ACH Credit Payment Instructions

A comprehensive guide for financial institutions regarding setting up EFT credit payments is available on the Department’s

internet site in the “e-services” section.

EFT-002 (R. 6-04)

Wisconsin Department of Revenue

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1