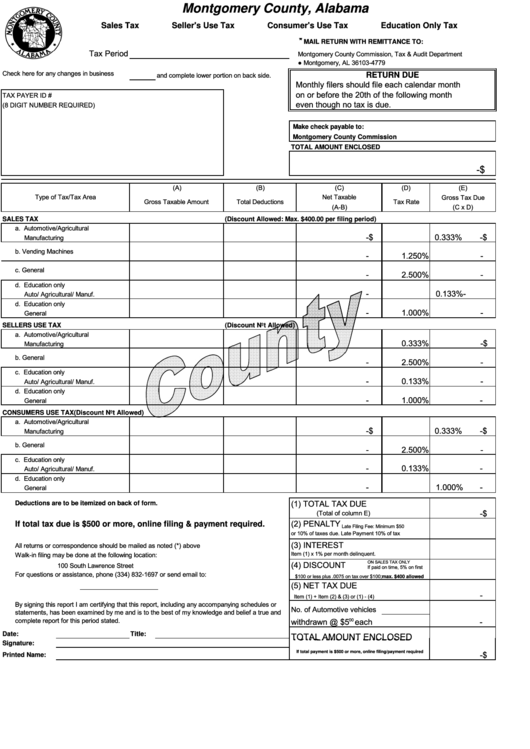

Sales Tax - Seller'S Use Tax - Consumer'S Use Tax - Education Only Tax Report Form - Montgomery County, Alabama

ADVERTISEMENT

Montgomery County, Alabama

Sales Tax

Seller's Use Tax

Consumer's Use Tax

Education Only Tax

*

MAIL RETURN WITH REMITTANCE TO:

Tax Period

Montgomery County Commission, Tax & Audit Department

P.O. Box 4779 ● Montgomery, AL 36103-4779

Check here for any changes in business

and complete lower portion on back side.

RETURN DUE

Monthly filers should file each calendar month

on or before the 20th of the following month

TAX PAYER ID #

even though no tax is due.

(8 DIGIT NUMBER REQUIRED)

Make check payable to:

Montgomery County Commission

TOTAL AMOUNT ENCLOSED

$

-

(A)

(B)

(C)

(D)

(E)

Type of Tax/Tax Area

Net Taxable

Gross Tax Due

Gross Taxable Amount

Total Deductions

Tax Rate

(A-B)

(C x D)

SALES TAX

(Discount Allowed: Max. $400.00 per filing period)

a. Automotive/Agricultural

$

-

0.333%

$

-

Manufacturing

b. Vending Machines

-

1.250%

-

c. General

-

2.500%

-

d. Education only

-

0.133%

-

Auto/ Agricultural/ Manuf.

d. Education only

-

1.000%

-

General

SELLERS USE TAX

(Discount Not Allowed)

a. Automotive/Agricultural

$

-

0.333%

$

-

Manufacturing

b. General

-

2.500%

-

c. Education only

-

0.133%

-

Auto/ Agricultural/ Manuf.

d. Education only

-

1.000%

-

General

CONSUMERS USE TAX

(Discount Not Allowed)

a. Automotive/Agricultural

$

-

0.333%

$

-

Manufacturing

b. General

-

2.500%

-

c. Education only

-

0.133%

-

Auto/ Agricultural/ Manuf.

d. Education only

-

1.000%

-

General

(1) TOTAL TAX DUE

Deductions are to be itemized on back of form.

$

-

(Total of column E)

(2) PENALTY

If total tax due is $500 or more, online filing & payment required.

Late Filing Fee: Minimum $50

or 10% of taxes due. Late Payment 10% of tax

(3) INTEREST

All returns or correspondence should be mailed as noted (*) above

Item (1) x 1% per month delinquent.

Walk-in filing may be done at the following location:

ON SALES TAX ONLY

(4) DISCOUNT

100 South Lawrence Street

If paid on time, 5% on first

For questions or assistance, phone (334) 832-1697 or send email to:

$100 or less plus .0075 on tax over $100;max. $400 allowed

(5) NET TAX DUE

-

Item (1) + Item (2) & (3) or (1) - (4)

By signing this report I am certifying that this report, including any accompanying schedules or

No. of Automotive vehicles

statements, has been examined by me and is to the best of my knowledge and belief a true and

complete report for this period stated.

withdrawn @ $5

each

-

00

Date:

Title:

TOTAL AMOUNT ENCLOSED

TOTAL AMOUNT ENCLOSED

Signature:

If total payment is $500 or more, online filing/payment required

$

-

Printed Name:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2