Motor Fuel Schedule Of Receipts Form - Iowa Department Of Revenue

ADVERTISEMENT

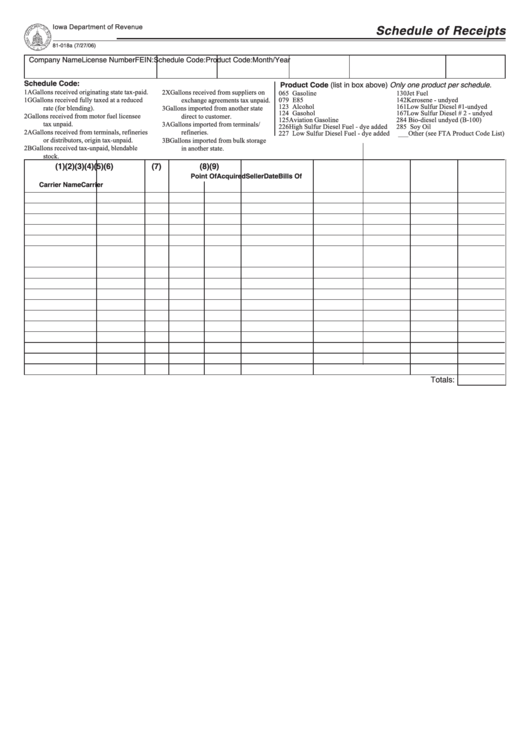

Iowa Department of Revenue

Schedule of Receipts

81-018a (7/27/06)

Company Name

License Number FEIN:

Schedule Code:

Product Code:

Month/Year

Schedule Code:

Product Code (list in box above) Only one product per schedule.

1A Gallons received originating state tax-paid.

2X Gallons received from suppliers on

065 Gasoline

130 Jet Fuel

079 E85

142 Kerosene - undyed

1G Gallons received fully taxed at a reduced

exchange agreements tax unpaid.

123 Alcohol

161 Low Sulfur Diesel #1-undyed

rate (for blending).

3

Gallons imported from another state

124 Gasohol

167 Low Sulfur Diesel # 2 - undyed

2

Gallons received from motor fuel licensee

direct to customer.

125 Aviation Gasoline

284 Bio-diesel undyed (B-100)

tax unpaid.

3A Gallons imported from terminals/

226 High Sulfur Diesel Fuel - dye added

285 Soy Oil

2A Gallons received from terminals, refineries

refineries.

227 Low Sulfur Diesel Fuel - dye added

___Other (see FTA Product Code List)

or distributors, origin tax-unpaid.

3B Gallons imported from bulk storage

2B Gallons received tax-unpaid, blendable

in another state.

stock.

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

Point Of

Acquired

Seller

Date

Bills Of

Carrier Name

Carrier FEIN

Mode

Origin

Dest.

From

FEIN

Received

Lading

Gross Gallons

Totals:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2