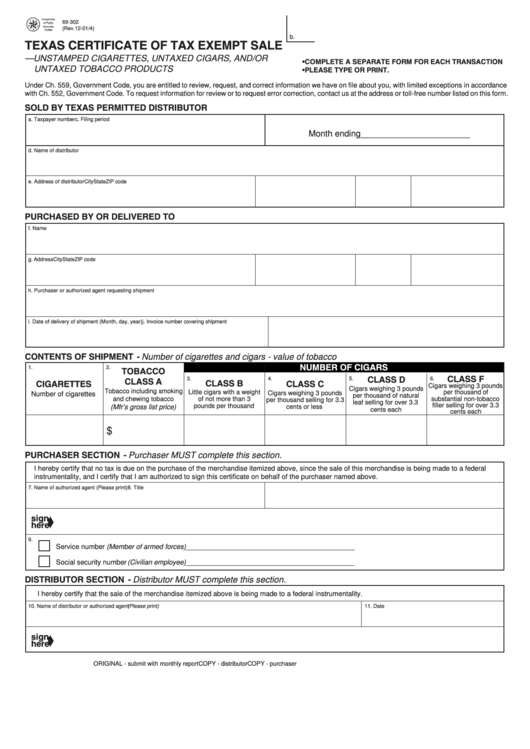

69-302

(Rev.12-01/4)

b.

TEXAS CERTIFICATE OF TAX EXEMPT SALE

—UNSTAMPED CIGARETTES, UNTAXED CIGARS, AND/OR

• COMPLETE A SEPARATE FORM FOR EACH TRANSACTION

UNTAXED TOBACCO PRODUCTS

• PLEASE TYPE OR PRINT.

Under Ch. 559, Government Code, you are entitled to review, request, and correct information we have on file about you, with limited exceptions in accordance

with Ch. 552, Government Code. To request information for review or to request error correction, contact us at the address or toll-free number listed on this form.

SOLD BY TEXAS PERMITTED DISTRIBUTOR

a. Taxpayer number

c. Filing period

Month ending _______________________

d. Name of distributor

e. Address of distributor

City

State

ZIP code

PURCHASED BY OR DELIVERED TO

f. Name

g. Address

City

State

ZIP code

h. Purchaser or authorized agent requesting shipment

i. Date of delivery of shipment (Month, day, year)

j. Invoice number covering shipment

CONTENTS OF SHIPMENT - Number of cigarettes and cigars - value of tobacco

NUMBER OF CIGARS

1.

2.

TOBACCO

CLASS F

3.

4.

5.

CLASS D

6.

CLASS A

CLASS B

CIGARETTES

CLASS C

Cigars weighing 3 pounds

Cigars weighing 3 pounds

Tobacco including smoking

Little cigars with a weight

per thousand of

Cigars weighing 3 pounds

Number of cigarettes

per thousand of natural

and chewing tobacco

of not more than 3

substantial non-tobacco

per thousand selling for 3.3

leaf selling for over 3.3

filler selling for over 3.3

pounds per thousand

(Mfr’s gross list price)

cents or less

cents each

cents each

$

PURCHASER SECTION - Purchaser MUST complete this section.

I hereby certify that no tax is due on the purchase of the merchandise itemized above, since the sale of this merchandise is being made to a federal

instrumentality, and I certify that I am authorized to sign this certificate on behalf of the purchaser named above.

7. Name of authorized agent (Please print)

8. Title

➧

sign

here

9.

Service number (Member of armed forces) ___________________________________________

Social security number (Civilian employee) ___________________________________________

DISTRIBUTOR SECTION - Distributor MUST complete this section.

I hereby certify that the sale of the merchandise itemized above is being made to a federal instrumentality.

10. Name of distributor or authorized agent (Please print)

11. Date

➧

sign

here

ORIGINAL - submit with monthly report

COPY - distributor

COPY - purchaser

1

1