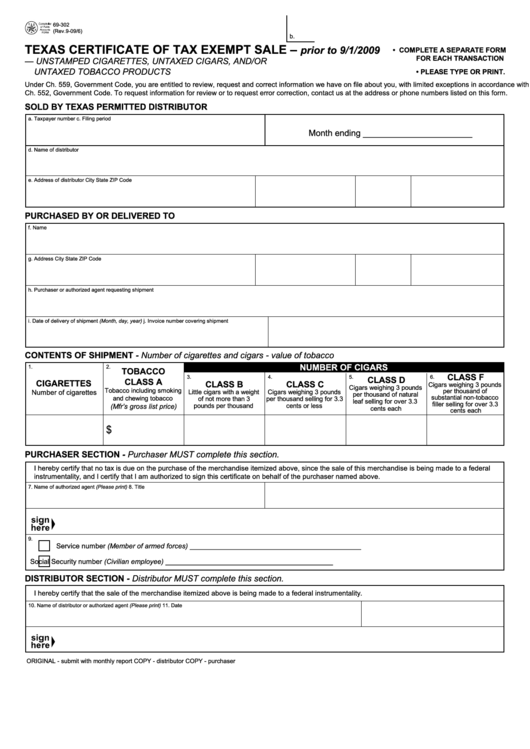

PRINT FORM

CLEAR FORM

69-302

(Rev.9-09/6)

b.

TEXAS CERTIFICATE OF TAX EXEMPT SALE –

prior to 9/1/2009

• COMPLETE A SEPARATE FORM

FOR EACH TRANSACTION

— UNSTAMPED CIGARETTES, UNTAXED CIGARS, AND/OR

UNTAXED TOBACCO PRODUCTS

• PLEASE TYPE OR PRINT.

Under Ch. 559, Government Code, you are entitled to review, request and correct information we have on file about you, with limited exceptions in accordance with

Ch. 552, Government Code. To request information for review or to request error correction, contact us at the address or phone numbers listed on this form.

SOLD BY TEXAS PERMITTED DISTRIBUTOR

a. Taxpayer number

c. Filing period

Month ending _______________________

d. Name of distributor

e. Address of distributor

City

State

ZIP Code

PURCHASED BY OR DELIVERED TO

f. Name

g. Address

City

State

ZIP Code

h. Purchaser or authorized agent requesting shipment

i. Date of delivery of shipment (Month, day, year)

j. Invoice number covering shipment

CONTENTS OF SHIPMENT - Number of cigarettes and cigars - value of tobacco

NUMBER OF CIGARS

1.

2.

TOBACCO

CLASS F

3.

4.

5.

6.

CLASS D

CLASS A

CIGARETTES

CLASS B

CLASS C

Cigars weighing 3 pounds

Cigars weighing 3 pounds

Tobacco including smoking

per thousand of

Number of cigarettes

Little cigars with a weight

Cigars weighing 3 pounds

per thousand of natural

substantial non-tobacco

and chewing tobacco

of not more than 3

per thousand selling for 3.3

leaf selling for over 3.3

filler selling for over 3.3

(Mfr’s gross list price)

pounds per thousand

cents or less

cents each

cents each

$

PURCHASER SECTION - Purchaser MUST complete this section.

I hereby certify that no tax is due on the purchase of the merchandise itemized above, since the sale of this merchandise is being made to a federal

instrumentality, and I certify that I am authorized to sign this certificate on behalf of the purchaser named above.

7. Name of authorized agent (Please print)

8. Title

9.

Service number (Member of armed forces) ____________________________________________

Social Security number (Civilian employee) ___________________________________________

DISTRIBUTOR SECTION - Distributor MUST complete this section.

I hereby certify that the sale of the merchandise itemized above is being made to a federal instrumentality.

10. Name of distributor or authorized agent (Please print)

11. Date

ORIGINAL - submit with monthly report

COPY - distributor

COPY - purchaser

1

1 2

2