Prescribed Tax Form Mcf-2 - Natural Gas Distribution Company Tax Return - Department Of Taxation Of State Of Ohio

ADVERTISEMENT

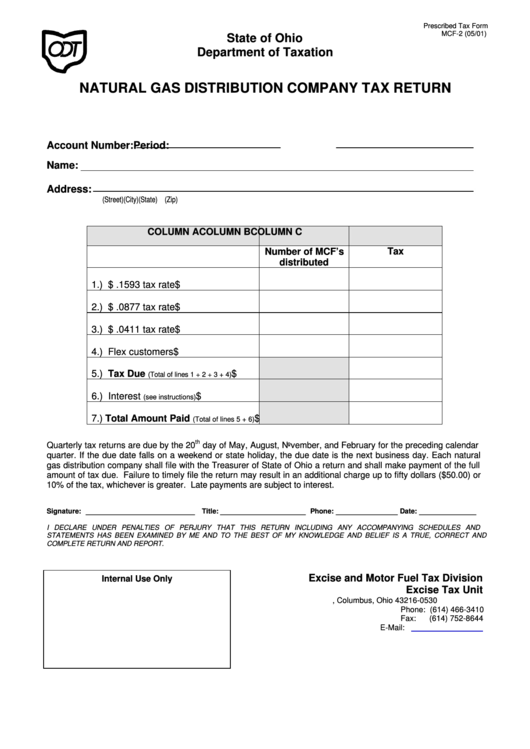

Prescribed Tax Form

MCF-2 (05/01)

State of Ohio

Department of Taxation

NATURAL GAS DISTRIBUTION COMPANY TAX RETURN

Account Number:

Period:

Name:

Address:

(Street)

(City)

(State)

(Zip)

COLUMN A

COLUMN B

COLUMN C

Number of MCF’s

Tax

distributed

1.) $ .1593 tax rate

$

2.) $ .0877 tax rate

$

3.) $ .0411 tax rate

$

4.) Flex customers

$

5.) Tax Due

$

(Total of lines 1 + 2 + 3 + 4)

6.) Interest

$

(see instructions)

7.) Total Amount Paid

$

(Total of lines 5 + 6)

th

Quarterly tax returns are due by the 20

day of May, August, November, and February for the preceding calendar

quarter. If the due date falls on a weekend or state holiday, the due date is the next business day. Each natural

gas distribution company shall file with the Treasurer of State of Ohio a return and shall make payment of the full

amount of tax due. Failure to timely file the return may result in an additional charge up to fifty dollars ($50.00) or

10% of the tax, whichever is greater. Late payments are subject to interest.

_______________________

__________________

_____________

____________

Signature:

Title:

Phone:

Date:

I DECLARE UNDER PENALTIES OF PERJURY THAT THIS RETURN INCLUDING ANY ACCOMPANYING SCHEDULES AND

STATEMENTS HAS BEEN EXAMINED BY ME AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IS A TRUE, CORRECT AND

COMPLETE RETURN AND REPORT.

Excise and Motor Fuel Tax Division

Internal Use Only

Excise Tax Unit

P.O. Box 530, Columbus, Ohio 43216-0530

Phone: (614) 466-3410

Fax:

(614) 752-8644

E-Mail:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1