Instructions For Form Mcf 2 - Natural Gas Distribution Company Tax Return

ADVERTISEMENT

MCF 2B

Rev. 4/04

•

P.O. Box 530

Columbus, OH 43216-0530

Instructions for Completing Natural Gas Distribution Company Tax Return

(MCF 2) (Companies Not Using Aggregation Tax Reporting Method)

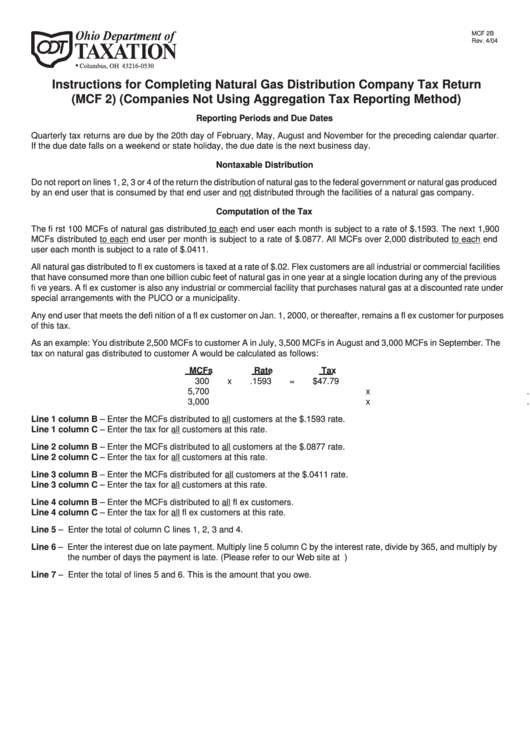

Reporting Periods and Due Dates

Quarterly tax returns are due by the 20th day of February, May, August and November for the preceding calendar quarter.

If the due date falls on a weekend or state holiday, the due date is the next business day.

Nontaxable Distribution

Do not report on lines 1, 2, 3 or 4 of the return the distribution of natural gas to the federal government or natural gas produced

by an end user that is consumed by that end user and not distributed through the facilities of a natural gas company.

Computation of the Tax

The fi rst 100 MCFs of natural gas distributed to each end user each month is subject to a rate of $.1593. The next 1,900

MCFs distributed to each end user per month is subject to a rate of $.0877. All MCFs over 2,000 distributed to each end

user each month is subject to a rate of $.0411.

All natural gas distributed to fl ex customers is taxed at a rate of $.02. Flex customers are all industrial or commercial facilities

that have consumed more than one billion cubic feet of natural gas in one year at a single location during any of the previous

fi ve years. A fl ex customer is also any industrial or commercial facility that purchases natural gas at a discounted rate under

special arrangements with the PUCO or a municipality.

Any end user that meets the defi nition of a fl ex customer on Jan. 1, 2000, or thereafter, remains a fl ex customer for purposes

of this tax.

As an example: You distribute 2,500 MCFs to customer A in July, 3,500 MCFs in August and 3,000 MCFs in September. The

tax on natural gas distributed to customer A would be calculated as follows:

MCFs

Rate

Tax

300

x

.1593

=

$47.79

5,700

x

.0877

=

$499.89

3,000

x

.0411

=

$123.30

Line 1 column B – Enter the MCFs distributed to all customers at the $.1593 rate.

Line 1 column C – Enter the tax for all customers at this rate.

Line 2 column B – Enter the MCFs distributed to all customers at the $.0877 rate.

Line 2 column C – Enter the tax for all customers at this rate.

Line 3 column B – Enter the MCFs distributed for all customers at the $.0411 rate.

Line 3 column C – Enter the tax for all customers at this rate.

Line 4 column B – Enter the MCFs distributed to all fl ex customers.

Line 4 column C – Enter the tax for all fl ex customers at this rate.

Line 5 – Enter the total of column C lines 1, 2, 3 and 4.

Line 6 – Enter the interest due on late payment. Multiply line 5 column C by the interest rate, divide by 365, and multiply by

the number of days the payment is late. (Please refer to our Web site at tax.ohio.gov for the current interest rate.)

Line 7 – Enter the total of lines 5 and 6. This is the amount that you owe.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2