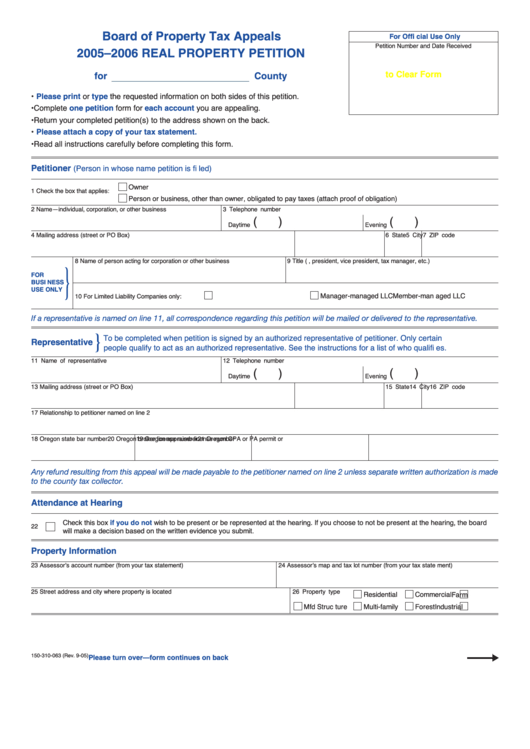

Board of Property Tax Appeals

For Offi cial Use Only

Petition Number and Date Received

2005–2006 REAL PROPERTY PETITION

Click Here to Clear Form

for

County

•

or

the requested information on both sides of this petition.

Please print

type

• Complete

form for

you are appealing.

one petition

each account

• Return your completed petition(s) to the address shown on the back.

•

Please attach a copy of your tax statement.

• Read all instructions carefully before completing this form.

Petitioner

(Person in whose name petition is fi led)

Owner

1 Check the box that applies:

Person or business, other than owner, obligated to pay taxes (attach proof of obligation)

2 Name—individual, corporation, or other business

3 Telephone number

(

)

(

)

Daytime

Evening

4 Mailing address (street or PO Box)

5 City

6 State

7 ZIP code

8 Name of person acting for corporation or other business

9 Title (i.e., president, vice president, tax manager, etc.)

}

FOR

BUSI NESS

USE ONLY

Member-man aged LLC

Manager-managed LLC

10 For Limited Liability Companies only:

If a representative is named on line 11, all correspondence regarding this petition will be mailed or delivered to the representative.

}

To be completed when petition is signed by an authorized representative of petitioner. Only certain

Representative

people qualify to act as an authorized representative. See the instructions for a list of who qualifi es.

11 Name of representative

12 Telephone number

(

)

(

)

Daytime

Evening

13 Mailing address (street or PO Box)

14 City

15 State

16 ZIP code

17 Relationship to petitioner named on line 2

18 Oregon state bar number

19 Oregon appraiser license number

20 Oregon broker license number

21 Oregon CPA or PA permit or S.E.A. number

Any refund resulting from this appeal will be made payable to the petitioner named on line 2 unless separate written authorization is made

to the county tax collector.

Attendance at Hearing

Check this box

wish to be present or be represented at the hearing. If you choose to not be present at the hearing, the board

if you do not

22

will make a decision based on the written evidence you submit.

Property Information

23 Assessor’s account number (from your tax statement)

24 Assessor’s map and tax lot number (from your tax state ment)

25 Street address and city where property is located

26 Property type

Residential

Commercial

Farm

Mfd Struc ture

Multi-family

Forest

Industrial

150-310-063 (Rev. 9-05)

Please turn over—form continues on back

1

1 2

2