THIS SUPPLEMENTAL FORM MUST BE SENT ATTACHED TO YOUR REGULAR SALES AND USE

TAX RETURN TO RECEIVE PROPER CREDIT .

This form is to be used as an account document to verify a transaction involving a “trade-in” or a “trade-down” and

must be completed and filed with your tax return. In the event of a sales tax audit, this document is used to verify

figures previously reported. THE SUPPLEMENTAL FORM MUST BE SENT ATTACHED TO THE REGULAR

FORM TO RECEIVE PROPER CREDIT.

CALCULATING TAX ON TRADE-INS

In accordance with NRS 374.070.3(f) vehicles accepted in trade on the purchase of another vehicle are allowed a

7

1

3

credit of 4½, 4¾, 4

/

5, 5

/

5¼, 5

/

or 5½ percent depending on the county of transaction. The credit allowed is

8,

8,

8

based on the trade-in value.

7

1

3

You must tax the vehicle being purchased at 6½, 6 ¾, 6

/

, 7

/

7, 7¼, 7

/

or 7½ percent of the full selling price and

8

8,

8

deduct 4 ½, 4 ¾, 5 or 5 ¼ percent tax of the value established for the vehicle being traded in. These calculations,

which are a part of the audit trail, must be clearly indicated on the sales agreement, as well as other records of the

sale.

Example of trade-in transaction:

A customer buys a vehicle from a Clark County auto dealer at a selling price of $11,850 and is allowed a

trade-in of $5,500 on his current vehicle. The dealer will calculate 7½ percent (.075) on $11,850 which

equals $888.75. He will then calculate 5½ percent (.055) on $5,500 which amounts to $302.50. The

amount of tax due is the net difference of $586.25.

Be certain the percentage used or calculation is the correct rate for the county where the transaction is taking place.

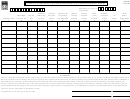

The SUPPLEMENTAL REPORTING FORM must be used to calculate trade-in transactions. Enter the total value

of trade-ins on the appropriate county tax rate line. Enter the calculated tax as shown for that county. Total the

calculated tax amounts and deduct the .005 percent collection allowance. The total is then deducted from the total

on line 25 of your regular tax return.

CALCULATING TAX ON TRADE-DOWNS

The Department has received inquiries from dealers on how to property calculate sales tax when a person is trading

in a vehicle of more value than the vehicle being purchased. Legislative Counsel has advised the Department that

the purchaser will always owe the 2 percent portion of the sales/use tax, regardless of excess credit allowed on the

value of the trade-in.

To calculate the amount of tax due for trade-downs, enter the selling price of the new vehicle. Add the total

amounts for selling price of the new vehicle and calculate at 2.0 percent. Deduct .005 percent collection allowance.

The total is added to the total on line 25 of your regular tax return. DO NOT INCLUDE THESE FIGURES IN

YOUR TOTAL SALES (Col. A on the regular return) OR TRADE-IN VALUES ON THE REGULAR TAX

RETURN

. The following is an example of a trade-down transaction:

Purchaser buys a motor vehicle with a sales price of $5,000. Purchaser trades in a motor vehicle on

which the dealer will allow the value of $10,000.

As there is no credit allowed on the 2 percent portion of the sales tax, the purchaser will owe 2

percent(.02) of the purchase price of the “new” vehicle, or in this case, $100.

TRADE IN SUPPLEMENTAL REPORT

MVH-TRD-01.01

Revised 10/13/03

1

1 2

2