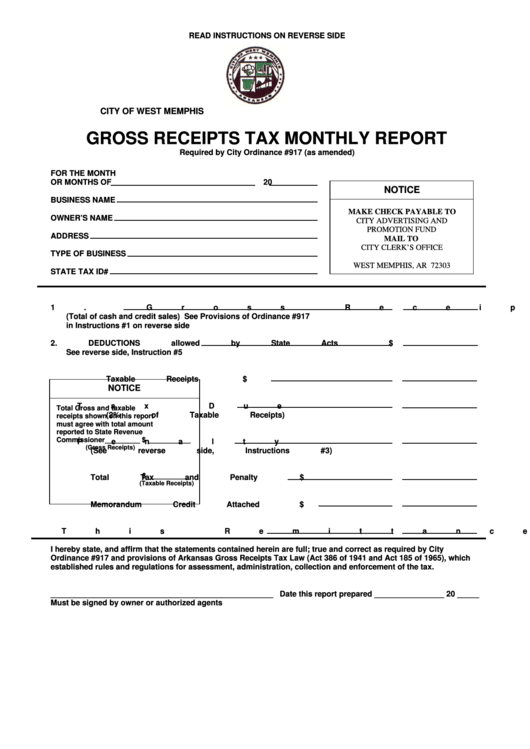

Gross Receipts Tax Monthly Report Form

ADVERTISEMENT

READ INSTRUCTIONS ON REVERSE SIDE

CITY OF WEST MEMPHIS

GROSS RECEIPTS TAX MONTHLY REPORT

Required by City Ordinance #917 (as amended)

FOR THE MONTH

OR MONTHS OF

20

NOTICE

BUSINESS NAME

MAKE CHECK PAYABLE TO

OWNER’S NAME

CITY ADVERTISING AND

PROMOTION FUND

ADDRESS

MAIL TO

CITY CLERK’S OFFICE

TYPE OF BUSINESS

P.O. BOX 1728

WEST MEMPHIS, AR 72303

STATE TAX ID#

1.

Gross Receipts

$

(Total of cash and credit sales) See Provisions of Ordinance #917

in Instructions #1 on reverse side

2.

DEDUCTIONS allowed by State Acts

$

See reverse side, Instruction #5

Taxable Receipts

$

NOTICE

Tax Due

$

Total Gross and taxable

(2% of Taxable Receipts)

receipts shown on this report

must agree with total amount

reported to State Revenue

Commissioner_________ $ ___________

Penalty

$

(Gross Receipts)

(See reverse side, Instructions #3)

$ ___________

Total Tax and Penalty

$

(Taxable Receipts)

Memorandum Credit Attached

$

This Remittance

$

I hereby state, and affirm that the statements contained herein are full; true and correct as required by City

Ordinance #917 and provisions of Arkansas Gross Receipts Tax Law (Act 386 of 1941 and Act 185 of 1965), which

established rules and regulations for assessment, administration, collection and enforcement of the tax.

___________________________________________________ Date this report prepared ________________ 20 _____

Must be signed by owner or authorized agents

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2