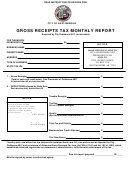

Gross Receipts Tax Monthly Report Form Page 2

ADVERTISEMENT

INSTRUCTIONS

1.

Chapter 3.04 of the West Memphis Municipal Code provides:

Section 3.04.020

A.

There is levied upon every firm, person, or corporation a tax of two percent upon

the gross receipts or gross proceeds from renting, leasing, or otherwise

furnishing hotel, motel or short-term condominium rental accomodations for

sleeping, meeting, or party room facilities for profit in the city and upon the gross

receipts or gross proceeds received by restaurants, cafes, cafeterias,

delicatessens, drive-in restaurants, carry-out restaurants, concession stands,

convenience stores, grocery store-restaurants, and similar businesses as shall

be defined in the levying ordinance from the sale of prepared food and beverages

for on- or off-premises consumption in the city.

B.

The tax shall be collected from the purchaser or user of the food or

accomodations by the person, firm, corporation, association, trust or estate (or

other entity of whatever nature) selling such food furnishing such accomodations

(the “taxpayer”), and the taxpayer shall remit to the City on the twentieth of each

month all collections of the tax for the preceding month, accompanied by reports

on forms to be furnished by the City.

C.

As provided in Act No. 185, the provisions of Act No. 386 of 1941, as amended,

together with the rules and regulations thereunder, shall so far as practicable,

apply to the administration, collection, assessment and enforcement of the tax.

2.

All information supplied in this report should be on the basis of actual records and all

records, including books of account, invoices, credit memoranda, refund slips and all

other evidence of every kind which will substantiate and prove the accuracy of the

return as made on this form are required to be kept for three (3) years, and open to the

examination and audit by the City of West Memphis.

3.

The return on this form is required to be mailed or delivered to the City Clerk’s office on

th

or before the 20

day each month and is for the preceding calendar month. Upon failure

th

to make and deliver the return by the 20

of the month, a penalty of 10% of the tax must

be added.

4.

Acceptance by the City Clerk of the tax remitted with any return shall not be conclusive

as to the correctness of the matters set forth by the taxpayer in the return and shall not

be finally determinative of the amount of tax liability.

5.

Total “OTHER DEDUCTIONS” claimed in item 2 of this return must be itemized, with

each identified and shown in separate amounts in the space provided below.

ITEM

AMT.

ITEM

AMT.

TOTAL

TOTAL

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2