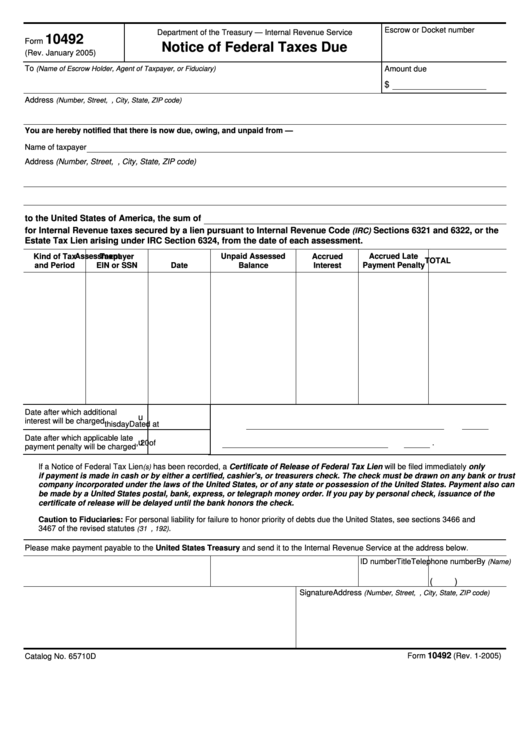

Escrow or Docket number

Department of the Treasury — Internal Revenue Service

10492

Form

Notice of Federal Taxes Due

(Rev. January 2005)

To

(Name of Escrow Holder, Agent of Taxpayer, or Fiduciary)

Amount due

$

Address

(Number, Street, P.O. Box, City, State, ZIP code)

You are hereby notified that there is now due, owing, and unpaid from —

Name of taxpayer

Address (Number, Street, P.O. Box, City, State, ZIP code)

to the United States of America, the sum of

for Internal Revenue taxes secured by a lien pursuant to Internal Revenue Code

Sections 6321 and 6322, or the

(IRC)

Estate Tax Lien arising under IRC Section 6324, from the date of each assessment.

Kind of Tax

Taxpayer

Assessment

Unpaid Assessed

Accrued

Accrued Late

TOTAL

and Period

EIN or SSN

Date

Balance

Interest

Payment Penalty

Date after which additional

u

interest will be charged

Dated at

this

day

Date after which applicable late

u

of

, 20

.

payment penalty will be charged

If a Notice of Federal Tax Lien

has been recorded, a Certificate of Release of Federal Tax Lien will be filed immediately only

(s)

if payment is made in cash or by either a certified, cashier's, or treasurers check. The check must be drawn on any bank or trust

company incorporated under the laws of the United States, or of any state or possession of the United States. Payment also can

be made by a United States postal, bank, express, or telegraph money order. If you pay by personal check, issuance of the

certificate of release will be delayed until the bank honors the check.

Caution to Fiduciaries: For personal liability for failure to honor priority of debts due the United States, see sections 3466 and

3467 of the revised statutes

.

(31 U.S.C. 191, 192)

Please make payment payable to the United States Treasury and send it to the Internal Revenue Service at the address below.

By

Title

ID number

Telephone number

(Name)

(

)

Address

Signature

(Number, Street, P.O. Box, City, State, ZIP code)

10492

Catalog No. 65710D

Form

(Rev. 1-2005)

1

1