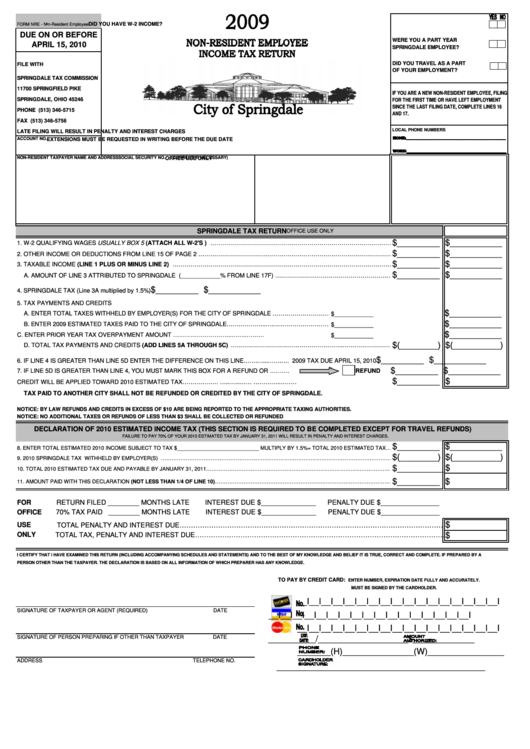

Form Nre - Non-Resident Employee Income Tax Return - 2009

ADVERTISEMENT

DID YOU HAVE W-2 INCOME?

FORM NRE - Non-Resident Employee

DUE ON OR BEFORE

WERE YOU A PART YEAR

APRIL 15, 2010

SPRINGDALE EMPLOYEE?

DID YOU TRAVEL AS A PART

FILE WITH

OF YOUR EMPLOYMENT?

SPRINGDALE TAX COMMISSION

11700 SPRINGFIELD PIKE

IF YOU ARE A NEW NON-RESIDENT EMPLOYEE, FILING

FOR THE FIRST TIME OR HAVE LEFT EMPLOYMENT

SPRINGDALE, OHIO 45246

SINCE THE LAST FILING DATE, COMPLETE LINES 16

PHONE (513) 346-5715

AND 17.

FAX (513) 346-5756

LOCAL PHONE NUMBERS

LATE FILING WILL RESULT IN PENALTY AND INTEREST CHARGES

ACCOUNT NO.

EXTENSIONS MUST BE REQUESTED IN WRITING BEFORE THE DUE DATE

NON-RESIDENT TAXPAYER NAME AND ADDRESS

(CORRECT IF NECESSARY)

SOCIAL SECURITY NO.

OFFICE USE ONLY

SPRINGDALE TAX RETURN

OFFICE USE ONLY

$_________ $___________

1. W-2 QUALIFYING WAGES USUALLY BOX 5 (ATTACH ALL W-2'S )……………………………………………………………………………………………………..

$_________ $___________

2. OTHER INCOME OR DEDUCTIONS FROM LINE 15 OF PAGE 2 ……………………………………………………………………………………………………………………

$_________ $___________

3. TAXABLE INCOME (LINE 1 PLUS OR MINUS LINE 2) …………………………………………………………………………………………………………………………..

$_________ $___________

A. AMOUNT OF LINE 3 ATTRIBUTED TO SPRINGDALE (____________% FROM LINE 17F) ………………………………………………………………..

$_________ $___________

4. SPRINGDALE TAX (Line 3A multiplied by 1.5%)

5. TAX PAYMENTS AND CREDITS

$___________

A. ENTER TOTAL TAXES WITHHELD BY EMPLOYER(S) FOR THE CITY OF SPRINGDALE …………………………………………………………………

$____________

$___________

B. ENTER 2009 ESTIMATED TAXES PAID TO THE CITY OF SPRINGDALE………………..….….…………………………………………………….

$____________

$___________

C. ENTER PRIOR YEAR TAX OVERPAYMENT AMOUNT ………………………...……..………..............................................................

$____________

$(________) $(__________)

D. TOTAL TAX PAYMENTS AND CREDITS (ADD LINES 5A THROUGH 5C)…………………………….…………………..……………………………………………..

$_________ $___________

6. IF LINE 4 IS GREATER THAN LINE 5D ENTER THE DIFFERENCE ON THIS LINE…….…...…….…. 2009 TAX DUE APRIL 15, 2010

$_________ $___________

7. IF LINE 5D IS GREATER THAN LINE 4, YOU MUST MARK THIS BOX FOR A REFUND OR ……….

REFUND

$_________ $

CREDIT WILL BE APPLIED TOWARD 2010 ESTIMATED TAX……………….....…..…...……....………….………...............2010 CREDIT

TAX PAID TO ANOTHER CITY SHALL NOT BE REFUNDED OR CREDITED BY THE CITY OF SPRINGDALE.

NOTICE: BY LAW REFUNDS AND CREDITS IN EXCESS OF $10 ARE BEING REPORTED TO THE APPROPRIATE TAXING AUTHORITIES.

NOTICE: NO ADDITIONAL TAXES OR REFUNDS OF LESS THAN $3 SHALL BE COLLECTED OR REFUNDED.

DECLARATION OF 2010 ESTIMATED INCOME TAX (THIS SECTION IS REQUIRED TO BE COMPLETED EXCEPT FOR TRAVEL REFUNDS)

FAILURE TO PAY 70% OF YOUR 2010 ESTIMATED TAX BY JANUARY 31, 2011 WILL RESULT IN PENALTY AND INTEREST CHARGES.

$_________ $___________

8. ENTER TOTAL ESTIMATED 2010 INCOME SUBJECT TO TAX $____________________________ MULTIPLY BY 1.5%= TOTAL 2010 ESTIMATED TAX………………

$(________) $(__________)

9. 2010 SPRINGDALE TAX WITHHELD BY EMPLOYER(S) ………………………………………………………………………………………………………………………………………………………………………………………………

$__________$

10. TOTAL 2010 ESTIMATED TAX DUE AND PAYABLE BY JANUARY 31, 2011……………………………………………………………………………………………………….

$_________ $

11. AMOUNT PAID WITH THIS DECLARATION (NOT LESS THAN 1/4 OF LINE 10)……………………………………………………………………………………………………………….

FOR

RETURN FILED ________ MONTHS LATE

INTEREST DUE $______________

PENALTY DUE $_______________

OFFICE

70% TAX PAID ________ MONTHS LATE

INTEREST DUE $______________

PENALTY DUE $_______________

$

USE

TOTAL PENALTY AND INTEREST DUE………………………………………………………………………………………………………..

ONLY

TOTAL TAX, PENALTY AND INTEREST DUE………………………………………………………………………………………………….

$

I CERTIFY THAT I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE, CORRECT AND COMPLETE. IF PREPARED BY A

PERSON OTHER THAN THE TAXPAYER, THE DECLARATION IS BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY KNOWLEDGE.

TO PAY BY CREDIT CARD:

ENTER NUMBER, EXPIRATION DATE FULLY AND ACCURATELY.

MUST BE SIGNED BY THE CARDHOLDER.

__I__I__I__I__I__I__I__I__I__I__I__I__I__I__I__I__I

SIGNATURE OF TAXPAYER OR AGENT (REQUIRED)

DATE

__I__I__I__I__I__I__I__I__I__I__I__I__I__I__I__I__I

__I__I__I__I__I__I__I__I__I__I__I__I__I__I__I__I__I

SIGNATURE OF PERSON PREPARING IF OTHER THAN TAXPAYER

DATE

__________/___________________$_____________

_______(H)_______________(W)________________

ADDRESS

TELEPHONE NO.

____________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2