Form Ri-1040s - Resident Individual Income Tax Return - 2009

ADVERTISEMENT

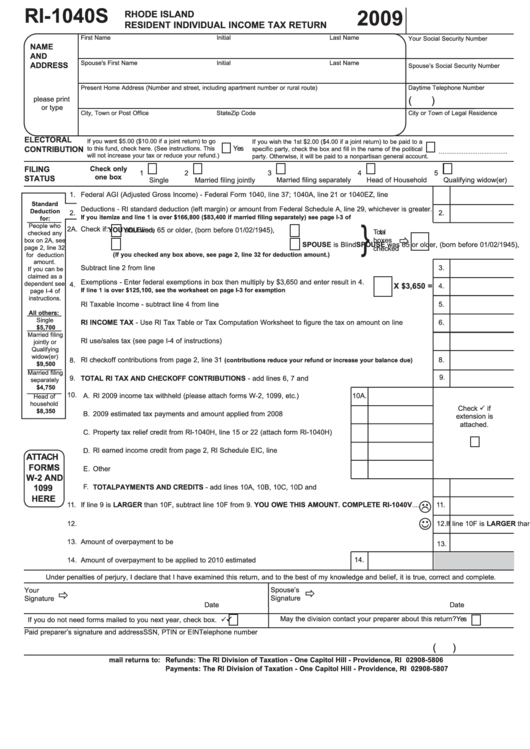

RI-1040S

2009

RHODE ISLAND

RESIDENT INDIVIDUAL INCOME TAX RETURN

First Name

Initial

Last Name

Your Social Security Number

NAME

AND

Spouse's First Name

Initial

Last Name

ADDRESS

Spouse’s Social Security Number

Present Home Address (Number and street, including apartment number or rural route)

Daytime Telephone Number

please print

(

)

or type

City, Town or Post Office

State

Zip Code

City or Town of Legal Residence

ELECTORAL

If you want $5.00 ($10.00 if a joint return) to go

If you wish the 1st $2.00 ($4.00 if a joint return) to be paid to a

to this fund, check here. (See instructions. This

Yes

CONTRIBUTION

specific party, check the box and fill in the name of the political

will not increase your tax or reduce your refund.)

party. Otherwise, it will be paid to a nonpartisan general account.

FILING

Check only

1

2

3

4

5

one box

STATUS

Single

Married filing jointly

Married filing separately

Head of Household

Qualifying widow(er)

1.

Federal AGI (Adjusted Gross Income) - Federal Form 1040, line 37; 1040A, line 21 or 1040EZ, line 4..................... 1.

Standard

Deductions - RI standard deduction (left margin) or amount from Federal Schedule A, line 29, whichever is greater.

Deduction

2.

2.

If you itemize and line 1 is over $166,800 ($83,400 if married filing separately) see page I-3 of instructions.............................

for:

People who

}

2A.

Check if:

YOU were 65 or older, (born before 01/02/1945),

YOU are Blind,

Total

checked any

boxes

box on 2A, see

SPOUSE was 65 or older, (born before 01/02/1945),

SPOUSE is Blind

page 2, line 32

checked

for deduction

(If you checked any box above, see page 2, line 32 for deduction amount.)

amount.

3.

Subtract line 2 from line 1.............................................................................................................................................

3.

If you can be

claimed as a

Exemptions - Enter federal exemptions in box then multiply by $3,650 and enter result in 4.

dependent see

4.

X $3,650 =

4.

If line 1 is over $125,100, see the worksheet on page I-3 for exemption amount......................................

page I-4 of

instructions.

5.

RI Taxable Income - subtract line 4 from line 3.............................................................................................................

5.

All others:

Single

6.

RI INCOME TAX - Use RI Tax Table or Tax Computation Worksheet to figure the tax on amount on line 5...............

6.

$5,700

Married filing

7.

RI use/sales tax (see page I-4 of instructions)..............................................................................................................

7.

jointly or

Qualifying

widow(er)

8.

RI checkoff contributions from page 2, line 31

............

8.

(contributions reduce your refund or increase your balance due)

$9,500

Married filing

9.

9.

TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS - add lines 6, 7 and 8..............................................................

separately

$4,750

10.

A.

RI 2009 income tax withheld (please attach forms W-2, 1099, etc.)...........................

10A.

Head of

household

Check

if

$8,350

B.

2009 estimated tax payments and amount applied from 2008 return......................... 10B.

extension is

attached.

C.

Property tax relief credit from RI-1040H, line 15 or 22 (attach form RI-1040H).......... 10C.

D.

RI earned income credit from page 2, RI Schedule EIC, line 23................................. 10D.

ATTACH

FORMS

E.

Other payments............................................................................................................ 10E.

W-2 AND

F.

TOTAL PAYMENTS AND CREDITS - add lines 10A, 10B, 10C, 10D and 10E.................................................... 10F.

1099

HERE

11.

If line 9 is LARGER than 10F, subtract line 10F from 9. YOU OWE THIS AMOUNT. COMPLETE RI-1040V ....

11.

☺

12.

If line 10F is LARGER than 9, subtract line 9 from 10F. THIS IS THE AMOUNT YOU OVERPAID...................

12.

13.

Amount of overpayment to be refunded........................................................................................................................

13.

14.

Amount of overpayment to be applied to 2010 estimated tax............................................

14.

Under penalties of perjury, I declare that I have examined this return, and to the best of my knowledge and belief, it is true, correct and complete.

Your

Spouse’s

Signature

Signature

Date

Date

May the division contact your preparer about this return?

Yes

If you do not need forms mailed to you next year, check box.

Paid preparer’s signature and address

SSN, PTIN or EIN

Telephone number

(

)

mail returns to:

Refunds: The RI Division of Taxation - One Capitol Hill - Providence, RI 02908-5806

Payments: The RI Division of Taxation - One Capitol Hill - Providence, RI 02908-5807

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2