NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

PA-30

ELDERLY AND DISABLED TAX DEFERRAL APPLICATION

DUE MARCH 1st FOLLOWING THE NOTICE OF TAX

GENERAL INSTRUCTIONS

Under the provisions of RSA 72:38-a, I, any resident property owner may apply for a tax deferral if they:

WHO

•

are either at least 65 years old or eligible under Title II or Title XVI of the Federal Social Security Act for benefi ts for the

MAY

disabled; and

FILE

•

have owned the homestead for at least 5 years if elderly or at least 1 year if disabled; and

•

are living in the home.

WHEN

The completed Form PA-30 shall be fi led by March 1st following the date of notice of tax. Example: If you are applying for an

TO

exemption from you 2005 property taxes, which are due no earlier than December 1, 2005, then you have until March 1, 2006

FILE

to fi le this form.

WHERE

Once completed and signed in black ink, this form shall be fi led as follows:

Original:

Register of Deeds.

TO

FILE

Copy:

Local Assessing Offi cials of the city/town of your primary residence.

Copy:

Property Owner.

TAX

The assessing offi cials may annually grant a person qualifi ed under this paragraph a tax deferral for all or part of the taxes due,

DEFERRAL

plus annual interest at 5 percent, if in their opinion the tax liability causes the taxpayer an undue hardship or possible loss of the

PROVISIONS

property. The total of tax deferrals on a particular property shall not be more than 85 percent of its equity value.

A tax deferral shall be subject to any prior liens on the property and shall be treated as such in any foreclosure proceedings.

If the property is subject to a mortgage, the owner must have the mortgage holder's approval of the tax deferral. Such approval

does not grant the town a preferential lien.

The assessing offi cials shall send written notice advising the taxpayer of their decision to grant or deny the request for exemption

APPEALS

by July 1st. Failure of the assessing offi cials to respond shall constitute a denial of the application.

If an application for a property tax deferral is denied, an applicant may appeal in writing on or before September 1st following

the date of notice of tax under RSA 72:1-d to the New Hampshire Board of Tax and Land Appeals or the County Superior Court.

Example: If you were denied a deferral from your 2005 property taxes, you have until September 1, 2006 to appeal.

Forms for appealing to the Board of Tax and Land Appeals may be obtained from the New Hampshire Board of Tax and Land

Appeals, 107 Pleasant Street, Concord, NH 03301 or by calling (603) 271-2578 or by visiting their web site at

Be sure to specify that you are appealing the Elderly and Disabled Tax Deferral application denial.

Individuals who need auxiliary aids for effective communication in programs and services of the department are invited to make

ADA

their needs and preferences known to the New Hampshire Department of Revenue Administration. Individuals with hearing or

speech impairments may call TDD Access: Relay NH 1-800-735-2964.

NEED

Contact your local municipality or the Property Appraisal Division at (603) 271-2687 or visit the Department's web site at

HELP?

LINE-BY-LINE INSTRUCTIONS

STEP 1

Enter the complete name and address of the property owner who is requesting a tax deferral under RSA 72:38-a.

STEP 2

Enter the location, street, municipality, county, number of acres, tax map number, lot number, book number and page number of

the property for which the RSA 72:38-a deferral is requested.

STEP 3

(a)

Enter the tax year for which the tax deferral is requested.

(b)

Enter the amount of the requested tax deferral.

(c)

Enter the amount of the tax bill for the year of this application.

(d)

Check the appropriate boxes to indicate that all of the qualifi cation requirements have been met.

ALL property owners of record must type or print their full name, sign and date in black ink acknowledging that they understand

STEP 4

and agree to the obligation incurred against the property by electing a deferral of taxes under RSA 72:38-a. If there are more than

four owners, submit a supplemental list of names and signatures.

STEP 5

Enter the name of the mortgage holder and obtain the signature of an authorized agent for the mortgage.

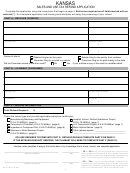

The local selectmen or tax assessors shall complete this step.

STEP 6

(a) Enter the amount of taxes deferred in prior years.

(b) Enter the amount of taxes requested for deferral in the current year.

(c)

Enter the total amount of the tax deferral (Step 6(a) plus Step 6(b).

STEP 7

The local selectmen or tax assessors shall complete this step.

(a) Enter the percentage of the total equity value encumbered under RSA 72:38-a in prior years.

(b) Enter the percentage of the total equity value encumbered under RSA 72:38-a in current year.

(c)

Enter the percentage of the total equity value encumbered for all years combined. (Step 7(a) plus Step 7(b).

If the result on Step 7(c) exceeds 85 percent, this application will be denied pursuant to RSA 72:38-a, I.

STEP 8

Signatures of a majority of the local selectmen or tax assessors on the lines provided indicates approval.

PA-30

Instructions

Page 3 of 3

Rev 6/2008

1

1 2

2 3

3