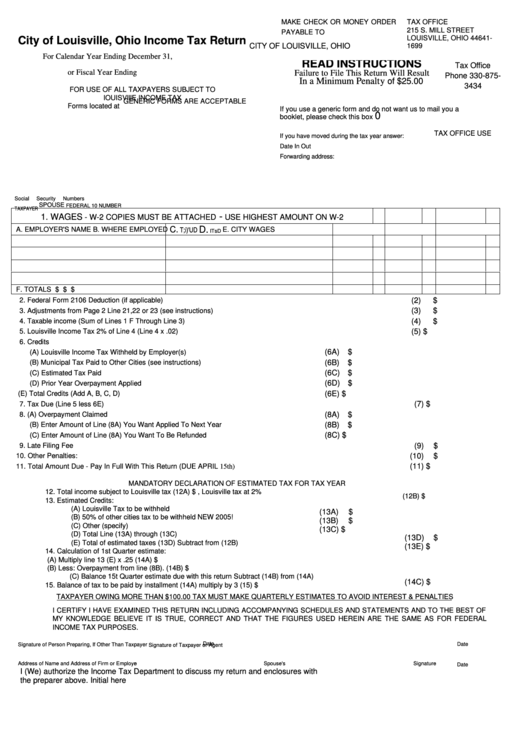

Ohio Income Tax Return Form - City Of Louisville

ADVERTISEMENT

MAKE CHECK OR MONEY ORDER

TAX OFFICE

215 S. MILL STREET

PAYABLE TO

LOUISVILLE, OHIO 44641-

City of Louisville, Ohio Income Tax Return

CITY OF LOUISVILLE, OHIO

1699

For Calendar Year Ending December 31,

READ INSTRUCTIONS

Tax Office

or Fiscal Year Ending

Failure to File This Return Will Result

Phone 330-875-

In a Minimum Penalty

of $25.00

3434

FOR USE OF ALL TAXPAYERS SUBJECT TO

lOUISVlllE INCOME TAX

GENERIC FORMS ARE ACCEPTABLE

Forms located at

If you use a generic form and do not want us to mail you a

0

booklet, please check this box

TAX OFFICE USE

If you have moved during the tax year answer:

Date In

Out

Forwarding address:

Social

Security

Numbers

SPOUSE

FEDERAL 10 NUMBER

TAXPAYER

-

1. WAGES

- W-2 COPIES MUST BE ATTACHED

USE HIGHEST AMOUNT ON W-2

T;i)'UD

D.

C.

A. EMPLOYER'S NAME

B. WHERE EMPLOYED

E. CITY WAGES

ITsD

F. TOTALS

$

$

$

(2)

$

2. Federal Form 2106 Deduction (if applicable)

(3)

$

3. Adjustments from Page 2 Line 21,22 or 23 (see instructions)

4. Taxable income (Sum of Lines 1 F Through Line 3)

(4)

$

(5) $

5. Louisville Income Tax 2% of Line 4 (Line 4 x .02)

6. Credits

(6A)

$

(A) Louisville Income Tax Withheld by Employer(s)

(6B)

$

(B) Municipal Tax Paid to Other Cities (see instructions)

(6C) $

(C) Estimated Tax Paid

(6D) $

(D) Prior Year Overpayment Applied

(6E) $

(E) Total Credits (Add A, B, C, D)

(7) $

7. Tax Due (Line 5 less 6E)

(8A)

$

8. (A) Overpayment Claimed

(B) Enter Amount of Line (8A) You Want Applied To Next Year

(8B)

$

(C) Enter Amount of Line (8A) You Want To Be Refunded

(8C) $

(9)

$

9. Late Filing Fee

10. Other Penalties:

(10)

$

(11) $

11. Total Amount Due - Pay In Full With This Return (DUE APRIL 15th)

MANDATORY DECLARATION OF ESTIMATED TAX FOR TAX YEAR

12. Total income subject to Louisville tax (12A) $

, Louisville tax at 2%

(12B) $

13. Estimated Credits:

(A) Louisville Tax to be withheld

(13A)

$

(B) 50% of other cities tax to be withheld NEW 2005!

(13B)

$

(C) Other (specify)

(13C) $

(D) Total Line (13A) through (13C)

(13D)

$

(E) Total of estimated taxes (13D) Subtract from (12B)

(13E) $

14. Calculation of 1st Quarter estimate:

(A) Multiply line 13 (E) x .25

(14A)

$

(B) Less: Overpayment from line (8B).

(14B)

$

(C) Balance 15t Quarter estimate due with this return Subtract (14B) from (14A)

(14C) $

15. Balance of tax to be paid by installment (14A) multiply by 3

(15)

$

TAXPAYER OWING MORE THAN $100.00 TAX MUST MAKE QUARTERLY ESTIMATES TO AVOID INTEREST & PENALTIES

I CERTIFY I HAVE EXAMINED THIS RETURN INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS AND TO THE BEST OF

MY KNOWLEDGE BELIEVE IT IS TRUE, CORRECT AND THAT THE FIGURES USED HEREIN ARE THE SAME AS FOR FEDERAL

INCOME TAX PURPOSES.

Date

Date

Signature of Person Preparing, If Other Than Taxpayer

Signature of Taxpayer or Agent

Address of Name and Address of Firm or Employer

Spouse's Signature

Date

I (We) authorize the Income Tax Department to discuss my return and enclosures with

the preparer above. Initial here

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2