Form Uc-522-Ff - Adjustment Report Form - Arizona Department Of Economic Security

ADVERTISEMENT

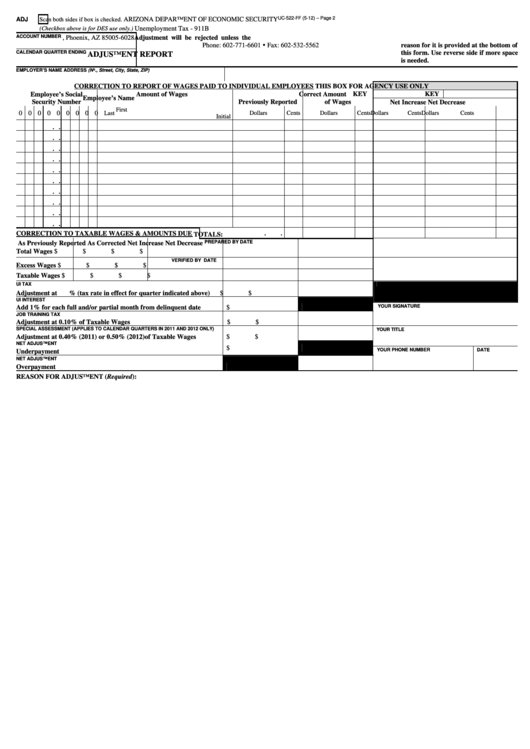

UC-522-FF (5-12) – Page 2

ARIZONA DEPARTMENT OF ECONOMIC SECURITY

ADJ

Scan both sides if box is checked.

Unemployment Tax - 911B

(Checkbox above is for DES use only.)

ACCOUNT NUMBER

P.O. Box 6028, Phoenix, AZ 85005-6028

Adjustment will be rejected unless the

Phone: 602-771-6601 Fax: 602-532-5562

reason for it is provided at the bottom of

CALENDAR QUARTER ENDING

this form. Use reverse side if more space

ADJUSTMENT REPORT

is needed.

EMPLOYER’S NAME

ADDRESS (No., Street, City, State, ZIP)

CORRECTION TO REPORT OF WAGES PAID TO INDIVIDUAL EMPLOYEES

THIS BOX FOR AGENCY USE ONLY

Employee’s Social

Amount of Wages

Correct Amount

KEY

KEY

Employee’s Name

Security Number

Previously Reported

of Wages

Net Increase

Net Decrease

First

0 0 0 0 0 0 0 0 0

Last

Dollars

Cents

Dollars

Cents

Dollars

Cents

Dollars

Cents

Initial

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

CORRECTION TO TAXABLE WAGES & AMOUNTS DUE

.

.

TOTALS:

PREPARED BY

DATE

As Previously Reported

As Corrected

Net Increase

Net Decrease

Total Wages

$

$

$

$

VERIFIED BY

DATE

Excess Wages

$

$

$

$

Taxable Wages

$

$

$

$

UI TAX

Adjustment at

% (tax rate in effect for quarter indicated above)

$

$

UI INTEREST

YOUR SIGNATURE

Add 1% for each full and/or partial month from delinquent date

$

JOB TRAINING TAX

Adjustment at 0.10% of Taxable Wages

$

$

SPECIAL ASSESSMENT (APPLIES TO CALENDAR QUARTERS IN 2011 AND 2012 ONLY)

YOUR TITLE

Adjustment at 0.40% (2011) or 0.50% (2012) of Taxable Wages

$

$

NET ADJUSTMENT

YOUR PHONE NUMBER

DATE

$

Underpayment

NET ADJUSTMENT

Overpayment

$

REASON FOR ADJUSTMENT (Required):

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1