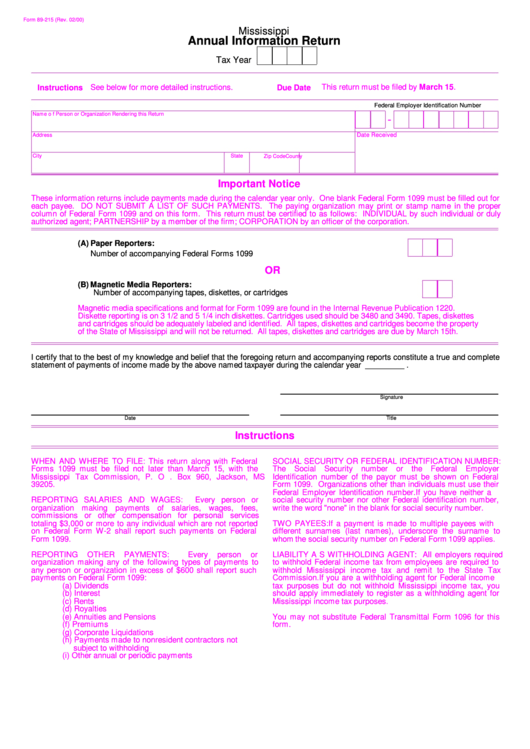

Form 89-215 - Annual Information Return

ADVERTISEMENT

Form 89-215 (Rev. 02/00)

Mississippi

Annual Information Return

Tax Year

See below for more detailed instructions.

This return must be filed by March 15.

Instructions

Due Date

Federal Employer Identification Number

Name of Person or Organization Rendering this Return

-

Date Received

Address

City

State

Zip Code

County

Important Notice

These information returns include payments made during the calendar year only. One blank Federal Form 1099 must be filled out for

each payee. DO NOT SUBMIT A LIST OF SUCH PAYMENTS. The paying organization may print or stamp name in the proper

column of Federal Form 1099 and on this form. This return must be certified to as follows: INDIVIDUAL by such individual or duly

authorized agent; PARTNERSHIP by a member of the firm; CORPORATION by an officer of the corporation.

(A) Paper Reporters:

Number of accompanying Federal Forms 1099..................................................................

OR

(B) Magnetic Media Reporters:

Number of accompanying tapes, diskettes, or cartridges..........................................................

Magnetic media specifications and format for Form 1099 are found in the Internal Revenue Publication 1220.

Diskette reporting is on 3 1/2 and 5 1/4 inch diskettes. Cartridges used should be 3480 and 3490. Tapes, diskettes

and cartridges should be adequately labeled and identified. All tapes, diskettes and cartridges become the property

of the State of Mississippi and will not be returned. All tapes, diskettes and cartridges are due by March 15th.

I certify that to the best of my knowledge and belief that the foregoing return and accompanying reports constitute a true and complete

statement of payments of income made by the above named taxpayer during the calendar year _________ .

Signature

Date

Title

Instructions

WHEN AND WHERE TO FILE: This return along with Federal

SOCIAL SECURITY OR FEDERAL IDENTIFICATION NUMBER:

Forms 1099 must be filed not later than March 15, with the

The Social Security

number

or

the Federal

Employer

Mississippi Tax Commission, P. O. Box 960, Jackson, MS

Identification number of the payor must be shown on Federal

39205.

Form 1099. Organizations other than individuals must use their

Federal Employer Identification number. If you have neither a

REPORTING SALARIES AND WAGES:

Every person or

social security number nor other Federal identification number,

organization making payments of salaries, wages, fees,

write the word "none" in the blank for social security number.

commissions or other compensation for personal services

totaling $3,000 or more to any individual which are not reported

TWO PAYEES: If a payment is made to multiple payees with

on Federal Form W-2 shall report such payments on Federal

different surnames (last names), underscore the surname to

Form 1099.

whom the social security number on Federal Form 1099 applies.

REPORTING

OTHER

PAYMENTS:

Every

person

or

LIABILITY AS WITHHOLDING AGENT: All employers required

organization making any of the following types of payments to

to withhold Federal income tax from employees are required to

any person or organization in excess of $600 shall report such

withhold Mississippi income tax and remit to the State Tax

payments on Federal Form 1099:

Commission. If you are a withholding agent for Federal income

(a) Dividends

tax purposes but do not withhold Mississippi income tax, you

(b) Interest

should apply immediately to register as a withholding agent for

(c) Rents

Mississippi income tax purposes.

(d) Royalties

(e) Annuities and Pensions

You may not substitute Federal Transmittal Form 1096 for this

(f) Premiums

form.

(g) Corporate Liquidations

(h) Payments made to nonresident contractors not

subject to withholding

(i) Other annual or periodic payments

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1