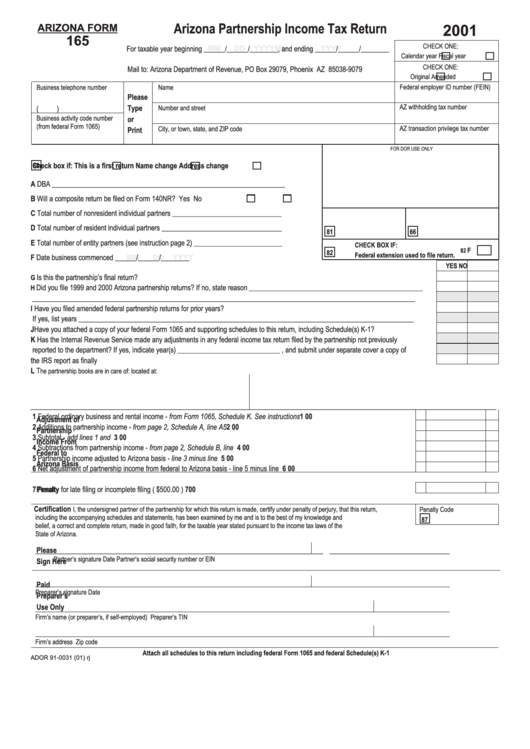

Arizona Form 165 - Arizona Partnership Income Tax Return - 2001

ADVERTISEMENT

Arizona Partnership Income Tax Return

2001

ARIZONA FORM

165

CHECK ONE:

MM

DD

YYYY

MM

DD

YYYY

For taxable year beginning ______/______/________, and ending ______/______/________

Calendar year

Fiscal year

CHECK ONE:

Mail to: Arizona Department of Revenue, PO Box 29079, Phoenix AZ 85038-9079

Original

Amended

Federal employer ID number (FEIN)

Business telephone number

Name

Please

AZ withholding tax number

Type

(

)

Number and street

Business activity code number

or

(from federal Form 1065)

AZ transaction privilege tax number

City, or town, state, and ZIP code

Print

FOR DOR USE ONLY

Check box if:

This is a rst return

Name change

Address change

68

A

DBA __________________________________________________________________

B

Will a composite return be led on Form 140NR?

Yes

No

C

Total number of nonresident individual partners _______________________________

D

Total number of resident individual partners __________________________________

81

66

E

Total number of entity partners (see instruction page 2) _________________________

CHECK BOX IF:

F

82

82

Federal extension used to le return.

F

Date business commenced ______/______/________

MM

DD

YYYY

YES

NO

Is this the partnership’s nal return?

G

...................................................................................................................................................................................

Did you le 1999 and 2000 Arizona partnership returns? If no, state reason

H

_______________________________________________________

_________________________________________________________________________________________________________________________

I

Have you led amended federal partnership returns for prior years? .............................................................................................................

If yes, list years _______________________________________________________________________________________________

J

Have you attached a copy of your federal Form 1065 and supporting schedules to this return, including Schedule(s) K-1? ........................

K

Has the Internal Revenue Service made any adjustments in any federal income tax return led by the partnership not previously

reported to the department? If yes, indicate year(s) _____________________________ , and submit under separate cover a copy of

the IRS report as nally determined................................................................................................................................................................

L

T

he partnership books are in care of:

located at:

____________________________________________________________________________________________________________________________________

1 Federal ordinary business and rental income - from Form 1065, Schedule K. See instructions........................

1

00

Adjustment of

2 Additions to partnership income - from page 2, Schedule A, line A5..................................................................

2

00

Partnership

3 Subtotal - add lines 1 and 2................................................................................................................................

3

00

Income From

4 Subtractions from partnership income - from page 2, Schedule B, line B6 ........................................................

4

00

Federal to

5 Partnership income adjusted to Arizona basis - line 3 minus line 4....................................................................

5

00

Arizona Basis

6 Net adjustment of partnership income from federal to Arizona basis - line 5 minus line 1 .................................

6

00

Penalty

7 Penalty for late ling or incomplete ling ( $500.00 )..........................................................................................

7

00

Certication

I, the undersigned partner of the partnership for which this return is made, certify under penalty of perjury, that this return,

Penalty Code

including the accompanying schedules and statements, has been examined by me and is to the best of my knowledge and

87

belief, a correct and complete return, made in good faith, for the taxable year stated pursuant to the income tax laws of the

State of Arizona.

Please

___________________________________________________________________________________________ ______________________________________

Partner’s signature

Date

Partner’s social security number or EIN

Sign Here

____________________________________________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________________________

Paid

Preparer’s signature

Date

Preparer’s

Use Only

___________________________________________________________________________________________________________________________________

Firm’s name (or preparer’s, if self-employed)

Preparer’s TIN

___________________________________________________________________________________________________________________________________

Firm’s address

Zip code

Attach all schedules to this return including federal Form 1065 and federal Schedule(s) K-1

ADOR 91-0031 (01) rj

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2