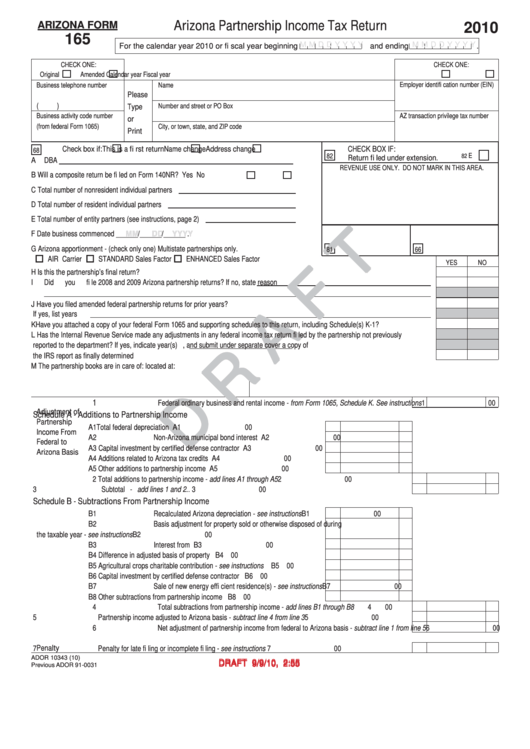

Arizona Form 165 Draft - Arizona Partnership Income Tax Return - 2010

ADVERTISEMENT

Arizona Partnership Income Tax Return

ARIZONA FORM

2010

165

M M D D Y Y Y Y

M M D D Y Y Y Y

For the calendar year 2010 or fi scal year beginning

and ending

.

CHECK ONE:

CHECK ONE:

Original

Amended

Calendar year

Fiscal year

Employer identifi cation number (EIN)

Business telephone number

Name

Please

(

)

Number and street or PO Box

Type

Business activity code number

AZ transaction privilege tax number

or

(from federal Form 1065)

City, or town, state, and ZIP code

Print

Check box if:

This is a fi rst return

Name change

Address change

CHECK BOX IF:

68

E

82

82

Return fi led under extension.

A

DBA

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

B

Will a composite return be fi led on Form 140NR?

Yes

No

C

Total number of nonresident individual partners

D

Total number of resident individual partners

E

Total number of entity partners (see instructions, page 2)

F

Date business commenced ______/______/______ .

MM

MM

DD

DD

YYYY

YYYY

G Arizona apportionment - (check only one) Multistate partnerships only.

81

66

AIR Carrier

STANDARD Sales Factor

ENHANCED Sales Factor

YES

NO

H

Is this the partnership’s fi nal return? ...............................................................................................................................................................

I

Did you fi le 2008 and 2009 Arizona partnership returns? If no, state reason

J

Have you fi led amended federal partnership returns for prior years? .............................................................................................................

If yes, list years

K

Have you attached a copy of your federal Form 1065 and supporting schedules to this return, including Schedule(s) K-1? ........................

L

Has the Internal Revenue Service made any adjustments in any federal income tax return fi led by the partnership not previously

reported to the department? If yes, indicate year(s)

, and submit under separate cover a copy of

the IRS report as fi nally determined ................................................................................................................................................................

M The partnership books are in care of:

located at:

1

Federal ordinary business and rental income - from Form 1065, Schedule K. See instructions ........................

1

00

Adjustment of

Schedule A - Additions to Partnership Income

Partnership

A1 Total federal depreciation ...................................................................................

A1

00

Income From

A2 Non-Arizona municipal bond interest .................................................................

A2

00

Federal to

A3 Capital investment by certifi ed defense contractor ............................................

A3

00

Arizona Basis

A4 Additions related to Arizona tax credits ..............................................................

A4

00

A5 Other additions to partnership income ...............................................................

A5

00

2 Total additions to partnership income - add lines A1 through A5 ........................................................................

2

00

3 Subtotal - add lines 1 and 2 ................................................................................................................................

3

00

Schedule B - Subtractions From Partnership Income

B1 Recalculated Arizona depreciation - see instructions.........................................

B1

00

B2 Basis adjustment for property sold or otherwise disposed of during

the taxable year - see instructions .....................................................................

B2

00

B3 Interest from U.S. government obligations .........................................................

B3

00

B4 Difference in adjusted basis of property .............................................................

B4

00

B5 Agricultural crops charitable contribution - see instructions ...............................

B5

00

B6 Capital investment by certifi ed defense contractor ............................................

B6

00

B7 Sale of new energy effi cient residence(s) - see instructions ..............................

B7

00

B8 Other subtractions from partnership income ......................................................

B8

00

4 Total subtractions from partnership income - add lines B1 through B8 ...............................................................

4

00

5 Partnership income adjusted to Arizona basis - subtract line 4 from line 3 .........................................................

5

00

6 Net adjustment of partnership income from federal to Arizona basis - subtract line 1 from line 5 ......................

6

00

Penalty

7 Penalty for late fi ling or incomplete fi ling - see instructions ................................................................................

7

00

ADOR 10343 (10)

DRAFT 9/9/10, 2:55 p.m.

DRAFT 9/9/10, 2:55 p.m.

Previous ADOR 91-0031

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2