Schedule H Form - Homeowner And Rental Property Tax Credit - 2001

ADVERTISEMENT

*019980310000*

*019980310000*

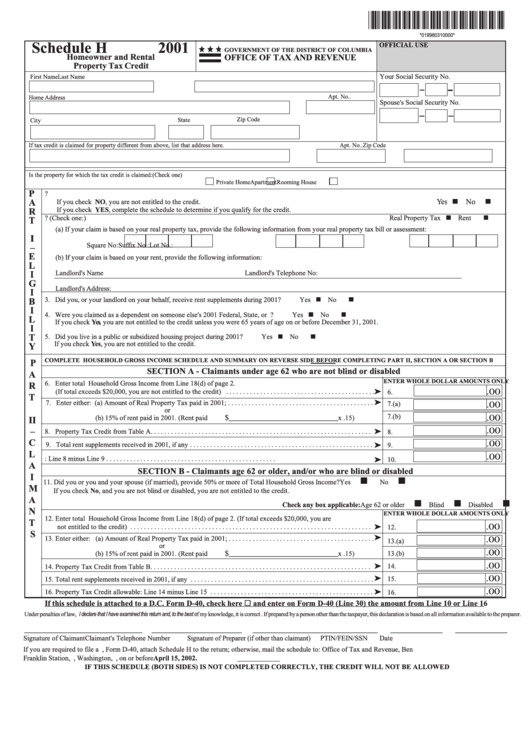

Schedule H

2001

OFFICIAL USE

GOVERNMENT OF THE DISTRICT OF COLUMBIA

Homeowner and Rental

OFFICE OF TAX AND REVENUE

Property Tax Credit

Your Social Security No.

First Name

Last Name

Apt. No..

Home Address

Spouse's Social Security No.

Zip Code

City

State

If tax credit is claimed for property different from above, list that address here.

Apt. No..

Zip Code

Is the property for which the tax credit is claimed: (Check one)

Private Home

Apartment

Rooming House

P

1. Did you rent or own your home in the District for the entire calendar year 2001?

Yes

No

If you check NO, you are not entitled to the credit.

A

If you check YES, complete the schedule to determine if you qualify for the credit.

R

Real Property Tax

Rent

2. Is your claim based on real property tax or rent? (Check one:)

T

(a) If your claim is based on your real property tax, provide the following information from your real property tax bill or assessment:

I

Square No:

Suffix No.:

Lot No.:

–

E

(b) If your claim is based on your rent, provide the following information:

L

Landlord's Name

Landlord's Telephone No:

I

G

Landlord's Address:

I

3. Did you, or your landlord on your behalf, receive rent supplements during 2001?

Yes

No

B

I

4. Were you claimed as a dependent on someone else's 2001 Federal, State, or D.C. Income Tax Return?

Yes

No

L

If you check Yes, you are not entitled to the credit unless you were 65 years of age on or before December 31, 2001.

I

5. Did you live in a public or subsidized housing project during 2001?

Yes

No

T

If you check Yes, you are not entitled to the credit.

Y

COMPLETE HOUSEHOLD GROSS INCOME SCHEDULE AND SUMMARY ON REVERSE SIDE BEFORE COMPLETING PART II, SECTION A OR SECTION B

P

SECTION A - Claimants under age 62 who are not blind or disabled

A

ENTER WHOLE DOLLAR AMOUNTS ONLY

6. Enter total Household Gross Income from Line 18(d) of page 2.

R

.00

(If total exceeds $20,000, you are not entitled to the credit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

T

7. Enter either: (a) Amount of Real Property Tax paid in 2001; . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.(a)

.00

or

7.(b)

$

.00

(b) 15% of rent paid in 2001. (Rent paid

_______________________________x .15)

II

.00

–

8. Property Tax Credit from Table A. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

C

.00

9. Total rent supplements received in 2001, if any . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

L

.00

10. Property Tax Credit allowable: Line 8 minus Line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10.

A

SECTION B - Claimants age 62 or older, and/or who are blind or disabled

I

11. Did you or you and your spouse (if married), provide 50% or more of Total Household Gross Income?

Yes

No

M

If you check No, and you are not blind or disabled, you are not entitled to the credit.

A

Check any box applicable: Age 62 or older

Blind

Disabled

N

ENTER WHOLE DOLLAR AMOUNTS ONLY

12. Enter total Household Gross Income from Line 18(d) of page 2. (If total exceeds $20,000, you are

T

.00

not entitled to the credit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12.

S

13. Enter either: (a) Amount of Real Property Tax paid in 2001; . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

13.(a)

or

.00

$

(b) 15% of rent paid in 2001. (Rent paid

_______________________________x .15)

13.(b)

.00

14.

14. Property Tax Credit from Table B. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

15.

15. Total rent supplements received in 2001, if any . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

16. Property Tax Credit allowable: Line 14 minus Line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16.

If this schedule is attached to a D.C. Form D-40, check here

and enter on Form D-40 (Line 30) the amount from Line 10 or Line 16

Under penalties of law, I declare that I have examined this return and, to the best of my knowledge, it is correct . If prepared by a person other than the taxpayer, this declaration is based on all information available to the preparer.

__________________________________

__________________________

____________________________________

_______________

_______________

Signature of Claimant

Claimant's Telephone Number

Signature of Preparer (if other than claimant)

PTIN/FEIN/SSN

Date

If you are required to file a D.C. Individual Income Tax Return, Form D-40, attach Schedule H to the return; otherwise, mail the schedule to: Office of Tax and Revenue, Ben

Franklin Station, P.O. Box 7861, Washington, D.C. 20044-7861, on or before April 15, 2002.

IF THIS SCHEDULE (BOTH SIDES) IS NOT COMPLETED CORRECTLY, THE CREDIT WILL NOT BE ALLOWED

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2