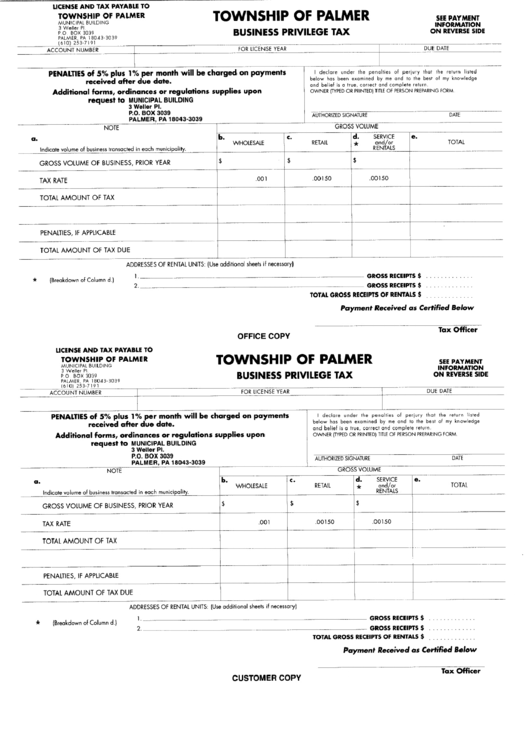

Business Privilege Tax Form - Township Of Palmer

ADVERTISEMENT

LICENSE AND TAX PAYABLE TO

TOWNSHIP OF PALMER

MUNICIPAL BUILDING

3 Weller PI

PO

BOX 3039

PALMER

PA

18043 3039

610 253 7191

TOWNSHIP OF

PALMER

BUSINESS PRIVILEGE TAX

SEE PAYMENT

INFORMATION

ON REVERSE SIDE

I

I

ACCOUNT NUMBER

FOR LICENSE YEAR

DUE DATE

I

PENALTIES of 5

plus

1

per month will be

charged

on

payments

I

declare

under the

penalties

of

perjury

that the

return

listed

received after due date

below has

been examined

by

me

and

to

the best of

my

knowledge

Additional forms ordinances

or

regulations supplies

upon

and belief is

a

true

correct

and

complete

return

OWNER

TYPED

OR PRINTED TITLE OF PERSON PREPARING FORM

request

to

MUNICIPAL BUILDING

3 Weller PI

P O BOX 3039

AUTHORIZED SIGNATURE

PALMER PA 18043 3039

DATE

NOTE

GROSS

VOLUME

b

a

c

d

SERVICE

Ie

Indicate volume of business transacted

in

each

municipality

WHOlESALE

RETAIL

and

or

TOTAL

RENTALS

GROSS VOLUME OF BUSINESS

PRIOR YEAR

I

TAX RATE

001

00150

00150

TOTAL

AMOUNT

OF TAX

1

J

I

PENAlTIES IF APPliCABlE

TOTAL AMOUNT OF TAX DUE

l

r

Breakdown of Column d

l

ADDRESSES OF RENTAL UNITS

Use additional sheets if

necessaryl

L

2

GROSS RECEIPTS

GROSS RECEIPTS

TOTAL GROSS RECEIPTS OF RENTALS

Payment

Received

as

Certified Below

Tax

OHicer

OFFICE COPY

LICENSE AND TAX PAYABLE TO

TOWNSHIP OF PALMER

MUNICIPAL BUILDING

3 Weller

PI

POBOX 3039

PALMER

PA 18043 3039

61 0

253 7 1 91

ACCOUNTNUMBER

I

PENALTIES of 5

plus

1

per month

will be

charged

on

payments

received after

due date

Additional forms ordinances

or

regulations supplies

upon

request

to

MUNICIPAL BUILDING

3 Weller PI

P O BOX 3039

PALMER PA 18043 3039

TOWNSHIP OF

PALMER

BUSINESS PRIVILEGE

TAX

SEE PAYMENT

INFORMATION

ON REVERSE SIDE

r

DUE DATE

FOR

LICENSE YEAR

I

declare

under

the

penalties

of

perjury

that the

return

listed

below

has been examined

by

me

and

to

the

best of

my

knowledge

and belief is

a

true

correct

and

complete

return

OWNER

TYPED

OR

PRINTEDI

TITLE OF PERSON PREPARING FORM

AUTHORIZED SIGNATURE

DATE

GROSS VOLUME

d

SERVICE

RETAIL

and

or

RENTALS

e

NOTE

a

b

c

TOTAL

WHOLESALE

Indicate volume of business transacted

in

each

munici

ali

GROSS VOLUME OF

BUSINESS

PRIOR YEAR

t

r

t

I

TAX RATE

001

00150

l

TOTAl

AMOUNT OF TAX

PENAlTIES IF

APPliCABLE

TOTAL AMOUNT OF TAX DUE

Breakdown of Column d

l

ADDRESSES OF RENTAL UNITS

Use additional sheets if

necessaryl

1

2

GROSS RECEIPTS

GROSS RECEIPTS

TOTAL GROSS RECEIPTS OF RENTALS

Payment

Received

as

Certified Below

Tax

OHicer

CUSTOMER COpy

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2