Form Ifta-115 - Alternative Tax Rate Claim For Fuel Use Tax Refund

ADVERTISEMENT

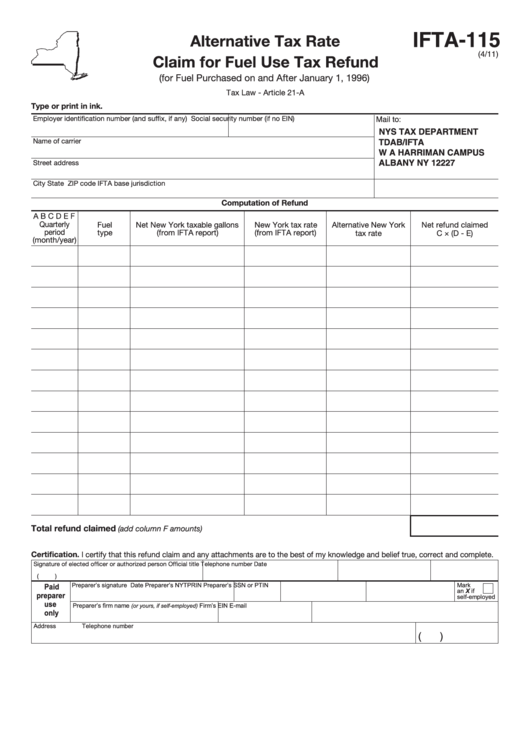

IFTA-115

Alternative Tax Rate

(4/11)

Claim for Fuel Use Tax Refund

(for Fuel Purchased on and After January 1, 1996)

Tax Law - Article 21-A

Type or print in ink.

Employer identification number (and suffix, if any)

Social security number (if no EIN)

Mail to:

NYS TAX DEPARTMENT

Name of carrier

TDAB/IFTA

W A HARRIMAN CAMPUS

ALBANY NY 12227

Street address

City

State

ZIP code IFTA base jurisdiction

Computation of Refund

A

B

C

D

E

F

Quarterly

Fuel

Net New York taxable gallons

New York tax rate

Alternative New York

Net refund claimed

period

type

(from IFTA report)

(from IFTA report)

tax rate

C × (D - E)

(month/year)

Total refund claimed

(add column F amounts) .............................................................................................

Certification. I certify that this refund claim and any attachments are to the best of my knowledge and belief true, correct and complete.

Signature of elected officer or authorized person

Official title

Telephone number

Date

(

)

Preparer’s signature

Date

Preparer’s NYTPRIN

Preparer’s SSN or PTIN

Mark

Paid

an X if

preparer

self-employed

use

Preparer’s firm name

Firm’s EIN

E-mail

(or yours, if self-employed)

only

Address

Telephone number

(

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1