Form W-3 - Wage Reconciliation Form - 2001

ADVERTISEMENT

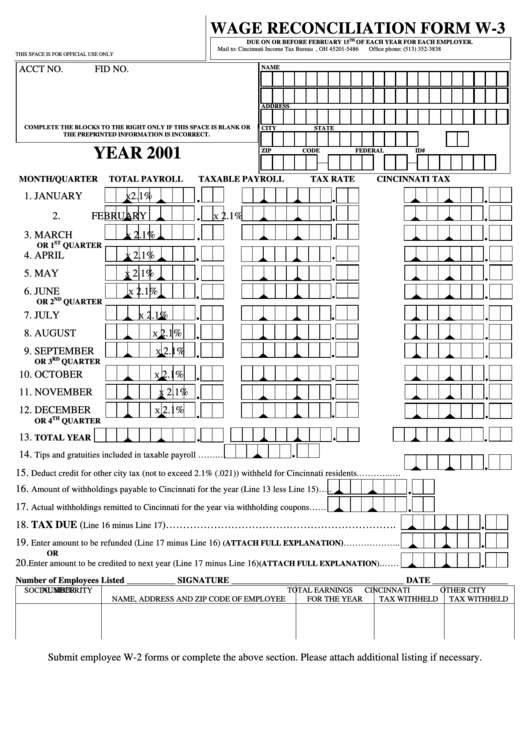

WAGE RECONCILIATION FORM W-3

TH

DUE ON OR BEFORE FEBRUARY 15

OF EACH YEAR FOR EACH EMPLOYER.

Mail to: Cincinnati Income Tax Bureau P.O. Box 5486 Cincinnati, OH 45201-5486

Office phone: (513) 352-3838

THIS SPACE IS FOR OFFICIAL USE ONLY

NAME

ACCT NO.

FID NO.

ADDRESS

COMPLETE THE BLOCKS TO THE RIGHT ONLY IF THIS SPACE IS BLANK OR

CITY

STATE

THE PREPRINTED INFORMATION IS INCORRECT.

YEAR 2001

ZIP CODE

FEDERAL ID#

MONTH/QUARTER

TOTAL PAYROLL

TAXABLE PAYROLL

TAX RATE

CINCINNATI TAX

1. JANUARY

2.1%

X

2. FEBRUARY

2.1%

X

3. MARCH

2.1%

X

ST

OR 1

QUARTER

4. APRIL

2.1%

X

5. MAY

2.1%

X

6. JUNE

2.1%

X

ND

OR 2

QUARTER

7. JULY

2.1%

X

8. AUGUST

2.1%

X

9. SEPTEMBER

2.1%

X

RD

OR 3

QUARTER

10. OCTOBER

2.1%

X

11. NOVEMBER

2.1%

X

12. DECEMBER

2.1%

X

TH

OR 4

QUARTER

13.

TOTAL YEAR

14.

Tips and gratuities included in taxable payroll …….…

15.

Deduct credit for other city tax (not to exceed 2.1% (.021)) withheld for Cincinnati residents.………..….

16.

Amount of withholdings payable to Cincinnati for the year (Line 13 less Line 15)…..

17.

Actual withholdings remitted to Cincinnati for the year via withholding coupons……

18. TAX DUE (

)………………………………………………………….

Line 16 minus Line 17

19.

Enter amount to be refunded (Line 17 minus Line 16)

)………………..

(ATTACH FULL EXPLANATION

OR

20.

Enter amount to be credited to next year (Line 17 minus Line 16)

.……

(ATTACH FULL EXPLANATION)

Number of Employees Listed ___________ SIGNATURE _______________________________________ DATE _________________

SOCIAL SECURITY

TOTAL EARNINGS

CINCINNATI

OTHER CITY

NUMBER

NAME, ADDRESS AND ZIP CODE OF EMPLOYEE

FOR THE YEAR

TAX WITHHELD

TAX WITHHELD

Submit employee W-2 forms or complete the above section. Please attach additional listing if necessary.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1