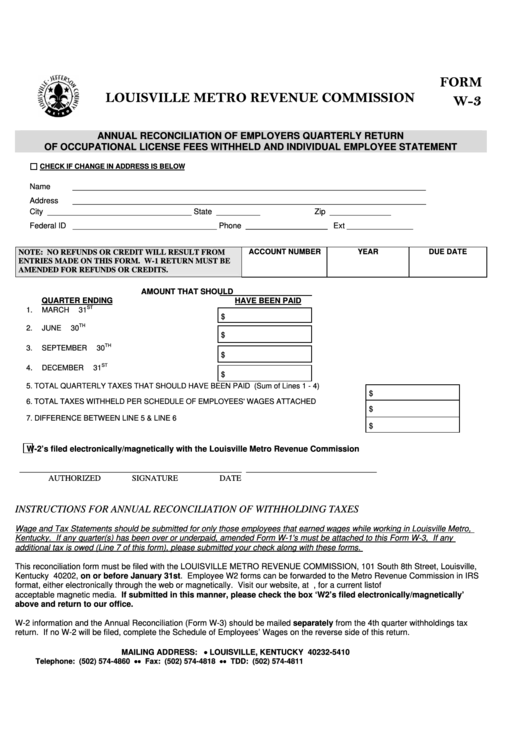

FORM

LOUISVILLE METRO REVENUE COMMISSION

3

W-

ANNUAL RECONCILIATION OF EMPLOYERS QUARTERLY RETURN

OF OCCUPATIONAL LICENSE FEES WITHHELD AND INDIVIDUAL EMPLOYEE STATEMENT

CHECK IF CHANGE IN ADDRESS IS BELOW

Name

_________________________________________________________________________________

Address

_________________________________________________________________________________

City

_________________________________

State __________

Zip ______________

Federal ID _________________________________

Phone

Ext

_____________________

_________________

ACCOUNT NUMBER

YEAR

DUE DATE

NOTE: NO REFUNDS OR CREDIT WILL RESULT FROM

ENTRIES MADE ON THIS FORM. W-1 RETURN MUST BE

AMENDED FOR REFUNDS OR CREDITS.

AMOUNT THAT SHOULD

QUARTER ENDING

HAVE BEEN PAID

ST

1.

MARCH 31

$

TH

2.

JUNE 30

$

TH

3.

SEPTEMBER 30

$

ST

4.

DECEMBER 31

$

5.

TOTAL QUARTERLY TAXES THAT SHOULD HAVE BEEN PAID (Sum of Lines 1 - 4)

$

6.

TOTAL TAXES WITHHELD PER SCHEDULE OF EMPLOYEES' WAGES ATTACHED

$

7.

DIFFERENCE BETWEEN LINE 5 & LINE 6

$

W-2’s filed electronically/magnetically with the Louisville Metro Revenue Commission

___________________________________________________

______________________________

AUTHORIZED SIGNATURE

DATE

INSTRUCTIONS FOR ANNUAL RECONCILIATION OF WITHHOLDING TAXES

Wage and Tax Statements should be submitted for only those employees that earned wages while working in Louisville Metro,

Kentucky. If any quarter(s) has been over or underpaid, amended Form W-1's must be attached to this Form W-3, If any

additional tax is owed (Line 7 of this form), please submitted your check along with these forms.

This reconciliation form must be filed with the LOUISVILLE METRO REVENUE COMMISSION, 101 South 8th Street, Louisville,

Kentucky 40202, on or before January 31st. Employee W2 forms can be forwarded to the Metro Revenue Commission in IRS

format, either electronically through the web or magnetically. Visit our website, at , for a current list of

acceptable magnetic media. If submitted in this manner, please check the box ‘W2’s filed electronically/magnetically’

above and return to our office.

W-2 information and the Annual Reconciliation (Form W-3) should be mailed separately from the 4th quarter withholdings tax

return. If no W-2 will be filed, complete the Schedule of Employees’ Wages on the reverse side of this return.

MAILING ADDRESS: P.O. BOX 35410 • LOUISVILLE, KENTUCKY 40232-5410

Telephone: (502) 574-4860 • • Fax: (502) 574-4818 • • TDD: (502) 574-4811

1

1 2

2