Form Fr 1111 - Income Tax Return, Willard Income Tax Form - City Of Willard, Ohio

ADVERTISEMENT

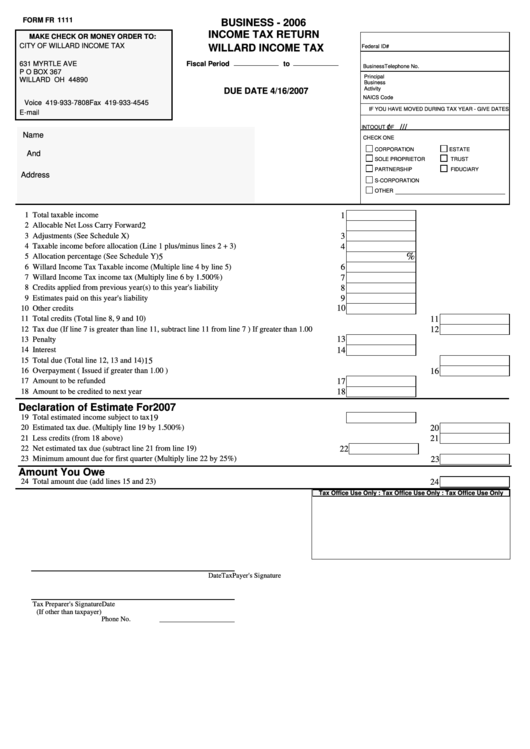

FORM FR

1111

BUSINESS - 2006

INCOME TAX RETURN

MAKE CHECK OR MONEY ORDER TO:

CITY OF WILLARD INCOME TAX

WILLARD INCOME TAX

Federal ID#

Fiscal Period

to

631 MYRTLE AVE

BusinessTelephone No.

P O BOX 367

Principal

WILLARD OH 44890

Business

Activity

DUE DATE 4/16/2007

NAICS Code

Voice 419-933-7808 Fax 419-933-4545

IF YOU HAVE MOVED DURING TAX YEAR - GIVE DATES

E-mail

/

/

/

/

INTO

OUT OF

Name

CHECK ONE

CORPORATION

ESTATE

And

SOLE PROPRIETOR

TRUST

PARTNERSHIP

FIDUCIARY

Address

S-CORPORATION

OTHER

1 Total taxable income

1

2 Allocable Net Loss Carry Forward

2

3 Adjustments (See Schedule X)

3

4 Taxable income before allocation (Line 1 plus/minus lines 2 + 3)

4

%

5 Allocation percentage (See Schedule Y)

5

6 Willard Income Tax Taxable income (Multiple line 4 by line 5)

6

7 Willard Income Tax income tax (Multiply line 6 by 1.500%)

7

8 Credits applied from previous year(s) to this year's liability

8

9 Estimates paid on this year's liability

9

10

10 Other credits

11 Total credits (Total line 8, 9 and 10)

11

12 Tax due (If line 7 is greater than line 11, subtract line 11 from line 7 ) If greater than 1.00

12

13

13 Penalty

14 Interest

14

15 Total due (Total line 12, 13 and 14)

15

16 Overpayment ( Issued if greater than 1.00 )

16

17 Amount to be refunded

17

18 Amount to be credited to next year

18

Declaration of Estimate For 2007

19 Total estimated income subject to tax

19

20 Estimated tax due. (Multiply line 19 by 1.500%)

20

21 Less credits (from 18 above)

21

22 Net estimated tax due (subtract line 21 from line 19)

22

23 Minimum amount due for first quarter (Multiply line 22 by 25%)

23

Amount You Owe

24 Total amount due (add lines 15 and 23)

24

Tax Office Use Only : Tax Office Use Only : Tax Office Use Only

TaxPayer's Signature

Date

Tax Preparer's Signature

Date

(If other than taxpayer)

Phone No.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1