Form Rev-854r - Entity Id (Ein)/filing Period/address Change - Replacement Coupon

ADVERTISEMENT

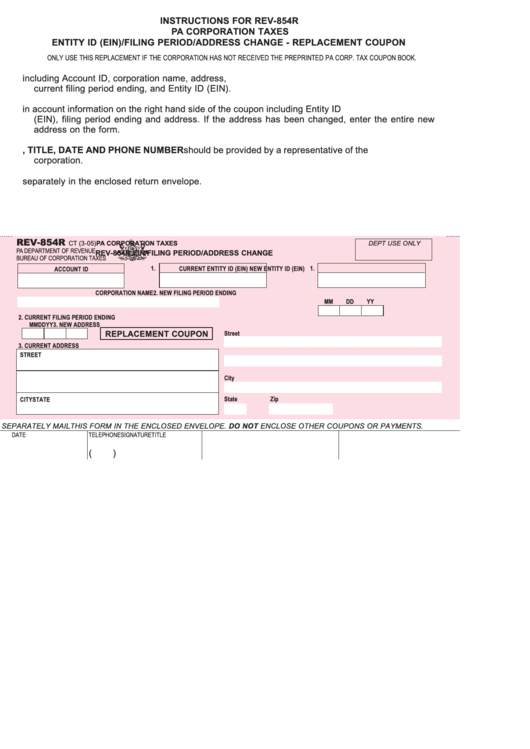

INSTRUCTIONS FOR REV-854R

PA CORPORATION TAXES

ENTITY ID (EIN)/FILING PERIOD/ADDRESS CHANGE - REPLACEMENT COUPON

ONLY USE THIS REPLACEMENT IF THE CORPORATION HAS NOT RECEIVED THE PREPRINTED PA CORP. TAX COUPON BOOK.

1. ENTER CURRENT ACCOUNT INFORMATION including Account ID, corporation name, address,

current filing period ending, and Entity ID (EIN).

2. ENTER CHANGES in account information on the right hand side of the coupon including Entity ID

(EIN), filing period ending and address. If the address has been changed, enter the entire new

address on the form.

3. SIGNATURE, TITLE, DATE AND PHONE NUMBER should be provided by a representative of the

corporation.

4. MAIL COUPON separately in the enclosed return envelope.

REV-854R

CT (3-05)

PA CORPORATION TAXES

DEPT USE ONLY

PA DEPARTMENT OF REVENUE

REV-854R EIN/FILING PERIOD/ADDRESS CHANGE

BUREAU OF CORPORATION TAXES

1.

1.

CURRENT ENTITY ID (EIN)

NEW ENTITY ID (EIN)

ACCOUNT ID

CORPORATION NAME

2. NEW FILING PERIOD ENDING

MM

DD

YY

2. CURRENT FILING PERIOD ENDING

MM

DD

YY

3. NEW ADDRESS

REPLACEMENT COUPON

Street

3. CURRENT ADDRESS

STREET

City

State

Zip

CITY

STATE

SEPARATELY MAIL THIS FORM IN THE ENCLOSED ENVELOPE. DO NOT ENCLOSE OTHER COUPONS OR PAYMENTS.

DATE

TELEPHONE

SIGNATURE

TITLE

(

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2