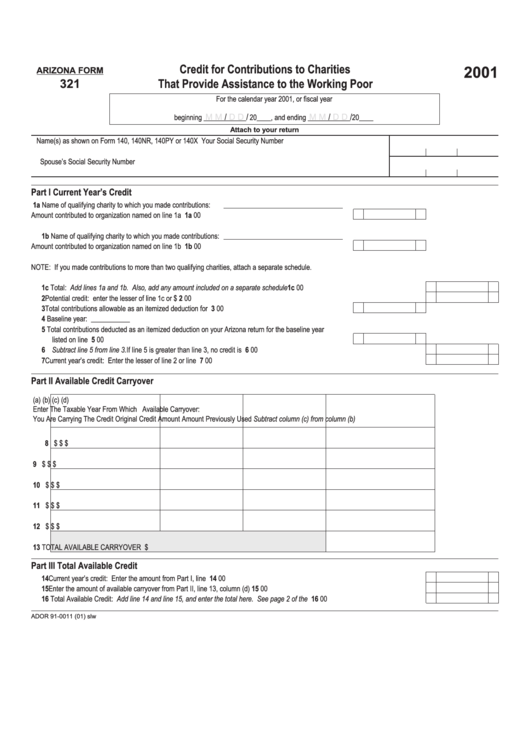

Arizona Form 321 - Credit For Contributions To Charities That Provide Assistance To The Working Poor - 2001

ADVERTISEMENT

Credit for Contributions to Charities

2001

ARIZONA FORM

321

That Provide Assistance to the Working Poor

For the calendar year 2001, or scal year

M M

/

D D

/

M M

/

D D

/

beginning ____________ 20____, and ending ____________ 20____

Attach to your return

Name(s) as shown on Form 140, 140NR, 140PY or 140X

Your Social Security Number

Spouse’s Social Security Number

Part I

Current Year’s Credit

1a Name of qualifying charity to which you made contributions:

Amount contributed to organization named on line 1a ..............................................................................

1a

00

1b Name of qualifying charity to which you made contributions:

Amount contributed to organization named on line 1b ..............................................................................

1b

00

NOTE: If you made contributions to more than two qualifying charities, attach a separate schedule.

1c Total: Add lines 1a and 1b. Also, add any amount included on a separate schedule .......................................................................

1c

00

2 Potential credit: enter the lesser of line 1c or $200............................................................................................................................

2

00

3 Total contributions allowable as an itemized deduction for 2001...............................................................

3

00

4 Baseline year: ___________

5 Total contributions deducted as an itemized deduction on your Arizona return for the baseline year

listed on line 4............................................................................................................................................

5

00

6 Subtract line 5 from line 3. If line 5 is greater than line 3, no credit is available. ...............................................................................

6

00

7 Current year’s credit: Enter the lesser of line 2 or line 6....................................................................................................................

7

00

Part II Available Credit Carryover

(a)

(b)

(c)

(d)

Enter The Taxable Year From Which

Available Carryover:

You Are Carrying The Credit

Original Credit Amount

Amount Previously Used

Subtract column (c) from column (b)

8

$

$

$

9

$

$

$

10

$

$

$

11

$

$

$

12

$

$

$

13 TOTAL AVAILABLE CARRYOVER

$

Part III Total Available Credit

14 Current year’s credit: Enter the amount from Part I, line 7 ................................................................................................................

14

00

15 Enter the amount of available carryover from Part II, line 13, column (d)...........................................................................................

15

00

16 Total Available Credit: Add line 14 and line 15, and enter the total here. See page 2 of the instructions.........................................

16

00

ADOR 91-0011 (01) slw

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1