Tax Return - Utility User Tax Form - City Of Stockton, California

ADVERTISEMENT

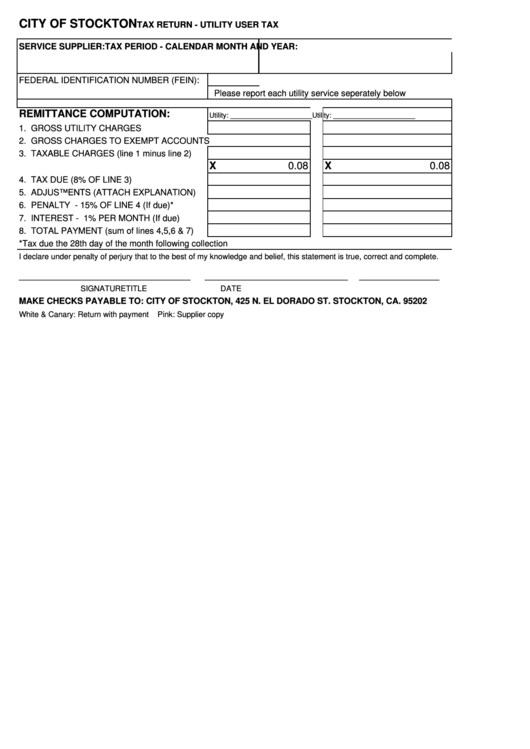

CITY OF STOCKTON

TAX RETURN - UTILITY USER TAX

SERVICE SUPPLIER:

TAX PERIOD - CALENDAR MONTH AND YEAR:

FEDERAL IDENTIFICATION NUMBER (FEIN):

Please report each utility service seperately below

REMITTANCE COMPUTATION:

Utility: _____________________

Utility: _____________________

1. GROSS UTILITY CHARGES

2. GROSS CHARGES TO EXEMPT ACCOUNTS

3. TAXABLE CHARGES (line 1 minus line 2)

X

0.08

X

0.08

4. TAX DUE (8% OF LINE 3)

5. ADJUSTMENTS (ATTACH EXPLANATION)

6. PENALTY - 15% OF LINE 4 (If due)*

7. INTEREST - 1% PER MONTH (If due)

8. TOTAL PAYMENT (sum of lines 4,5,6 & 7)

*Tax due the 28th day of the month following collection

I declare under penalty of perjury that to the best of my knowledge and belief, this statement is true, correct and complete.

______________________________

_________________________

______________

SIGNATURE

TITLE

DATE

MAKE CHECKS PAYABLE TO: CITY OF STOCKTON, 425 N. EL DORADO ST. STOCKTON, CA. 95202

White & Canary: Return with payment

Pink: Supplier copy

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1