Prepared Food And Beverage Tax Return Form

ADVERTISEMENT

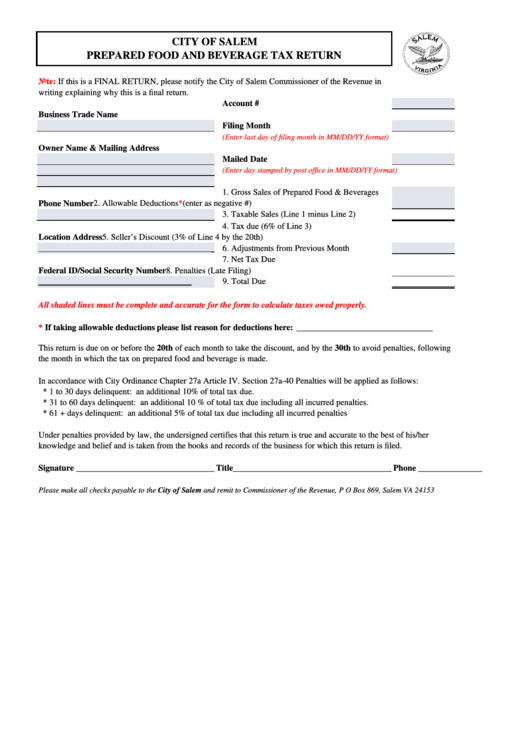

CITY OF SALEM

PREPARED FOOD AND BEVERAGE TAX RETURN

Note:

If this is a FINAL RETURN, please notify the City of Salem Commissioner of the Revenue in

writing explaining why this is a final return.

Account #

Business Trade Name

Filing Month

(Enter last day of filing month in MM/DD/YY format)

Owner Name & Mailing Address

Mailed Date

(Enter day stamped by post office in MM/DD/YY format)

1. Gross Sales of Prepared Food & Beverages

Phone Number

2. Allowable Deductions*(enter as negative #)

3. Taxable Sales (Line 1 minus Line 2)

4. Tax due (6% of Line 3)

Location Address

5. Seller’s Discount (3% of Line 4 by the 20th)

6. Adjustments from Previous Month

______________________________________________

7. Net Tax Due

Federal ID/Social Security Number

8. Penalties (Late Filing)

____________________________________

9. Total Due

All shaded lines must be complete and accurate for the form to calculate taxes owed properly.

*

If taking allowable deductions please list reason for deductions here: ________________________________

This return is due on or before the 20th of each month to take the discount, and by the 30th to avoid penalties, following

the month in which the tax on prepared food and beverage is made.

In accordance with City Ordinance Chapter 27a Article IV. Section 27a-40 Penalties will be applied as follows:

* 1 to 30 days delinquent: an additional 10% of total tax due.

* 31 to 60 days delinquent: an additional 10 % of total tax due including all incurred penalties.

* 61 + days delinquent: an additional 5% of total tax due including all incurred penalties

Under penalties provided by law, the undersigned certifies that this return is true and accurate to the best of his/her

knowledge and belief and is taken from the books and records of the business for which this return is filed.

Signature _________________________________Title______________________________________Phone _______________

Please make all checks payable to the City of Salem and remit to Commissioner of the Revenue, P O Box 869, Salem VA 24153

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1