Tax Return On Sales Of Prepared Food And Certain Alcoholic Beverages Form - City Of Collinsville

ADVERTISEMENT

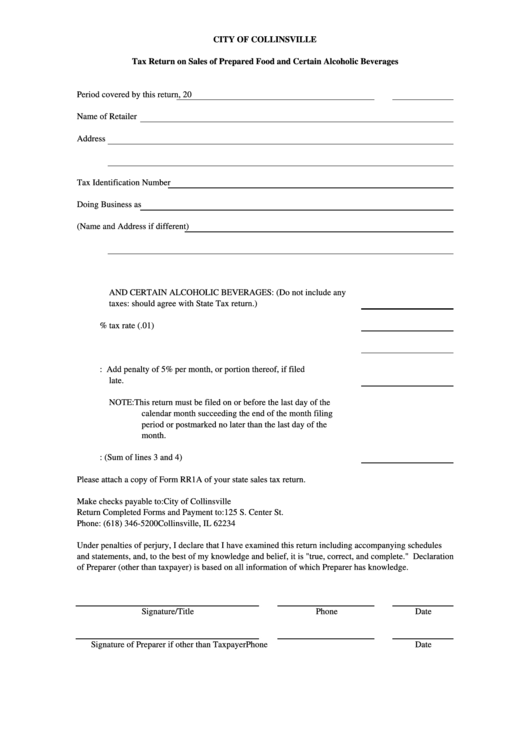

CITY OF COLLINSVILLE

Tax Return on Sales of Prepared Food and Certain Alcoholic Beverages

Period covered by this return

, 20

Name of Retailer

Address

Tax Identification Number

Doing Business as

(Name and Address if different)

1. SALES OF PREPARED FOOD FOR IMMEDIATE CONSUMPTION

AND CERTAIN ALCOHOLIC BEVERAGES: (Do not include any

taxes: should agree with State Tax return.)

2. Multiply by 1% tax rate (.01)

3. TAX DUE AND PAYABLE

4. PENALTY: Add penalty of 5% per month, or portion thereof, if filed

late.

NOTE: This return must be filed on or before the last day of the

calendar month succeeding the end of the month filing

period or postmarked no later than the last day of the

month.

5. TOTAL PAYMENT DUE: (Sum of lines 3 and 4)

Please attach a copy of Form RR1A of your state sales tax return.

Make checks payable to:

City of Collinsville

Return Completed Forms and Payment to:

125 S. Center St.

Phone: (618) 346-5200

Collinsville, IL 62234

Under penalties of perjury, I declare that I have examined this return including accompanying schedules

and statements, and, to the best of my knowledge and belief, it is "true, correct, and complete." Declaration

of Preparer (other than taxpayer) is based on all information of which Preparer has knowledge.

Signature/Title

Phone

Date

Signature of Preparer if other than Taxpayer

Phone

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1