Form Ft-1012 - Manufacturing Certification For Non-Highway Diesel Motor Fuel And Residual Petroleum Product

ADVERTISEMENT

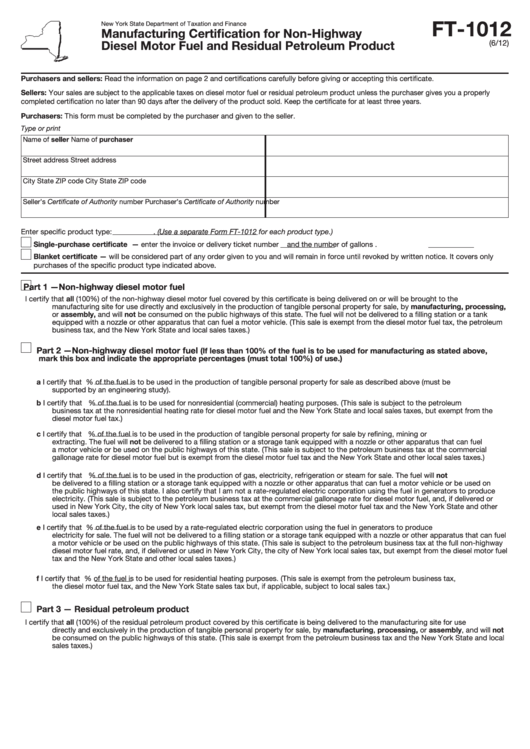

FT-1012

New York State Department of Taxation and Finance

Manufacturing Certification for Non-Highway

Diesel Motor Fuel and Residual Petroleum Product

(6/12)

Purchasers and sellers: Read the information on page 2 and certifications carefully before giving or accepting this certificate.

Sellers: Your sales are subject to the applicable taxes on diesel motor fuel or residual petroleum product unless the purchaser gives you a properly

completed certification no later than 90 days after the delivery of the product sold. Keep the certificate for at least three years.

Purchasers: This form must be completed by the purchaser and given to the seller.

Type or print

Name of seller

Name of purchaser

Street address

Street address

City

State

ZIP code

City

State

ZIP code

Seller’s Certificate of Authority number

Purchaser’s Certificate of Authority number

Enter specific product type:

. (Use a separate Form FT-1012 for each product type.)

Single-purchase certificate — enter the invoice or delivery ticket number

and the number of gallons

.

Blanket certificate — will be considered part of any order given to you and will remain in force until revoked by written notice. It covers only

purchases of the specific product type indicated above.

Part 1 — Non-highway diesel motor fuel

I certify that all (100%) of the non-highway diesel motor fuel covered by this certificate is being delivered on or will be brought to the

manufacturing site for use directly and exclusively in the production of tangible personal property for sale, by manufacturing, processing,

or assembly, and will not be consumed on the public highways of this state. The fuel will not be delivered to a filling station or a tank

equipped with a nozzle or other apparatus that can fuel a motor vehicle. (This sale is exempt from the diesel motor fuel tax, the petroleum

business tax, and the New York State and local sales taxes.)

Part 2 — Non-highway diesel motor fuel

(If less than 100% of the fuel is to be used for manufacturing as stated above,

mark this box and indicate the appropriate percentages (must total 100%) of use.)

a

I certify that

% of the fuel is to be used in the production of tangible personal property for sale as described above (must be

supported by an engineering study).

b

I certify that

% of the fuel is to be used for nonresidential (commercial) heating purposes. (This sale is subject to the petroleum

business tax at the nonresidential heating rate for diesel motor fuel and the New York State and local sales taxes, but exempt from the

diesel motor fuel tax.)

c

I certify that

% of the fuel is to be used in the production of tangible personal property for sale by refining, mining or

extracting. The fuel will not be delivered to a filling station or a storage tank equipped with a nozzle or other apparatus that can fuel

a motor vehicle or be used on the public highways of this state. (This sale is subject to the petroleum business tax at the commercial

gallonage rate for diesel motor fuel but is exempt from the diesel motor fuel tax and the New York State and other local sales taxes.)

d

I certify that

% of the fuel is to be used in the production of gas, electricity, refrigeration or steam for sale. The fuel will not

be delivered to a filling station or a storage tank equipped with a nozzle or other apparatus that can fuel a motor vehicle or be used on

the public highways of this state. I also certify that I am not a rate-regulated electric corporation using the fuel in generators to produce

electricity. (This sale is subject to the petroleum business tax at the commercial gallonage rate for diesel motor fuel, and, if delivered or

used in New York City, the city of New York local sales tax, but exempt from the diesel motor fuel tax and the New York State and other

local sales taxes.)

e

I certify that

% of the fuel is to be used by a rate-regulated electric corporation using the fuel in generators to produce

electricity for sale. The fuel will not be delivered to a filling station or a storage tank equipped with a nozzle or other apparatus that can fuel

a motor vehicle or be used on the public highways of this state. (This sale is subject to the petroleum business tax at the full non-highway

diesel motor fuel rate, and, if delivered or used in New York City, the city of New York local sales tax, but exempt from the diesel motor fuel

tax and the New York State and other local sales taxes.)

f

I certify that

% of the fuel is to be used for residential heating purposes. (This sale is exempt from the petroleum business tax,

the diesel motor fuel tax, and the New York State sales tax but, if applicable, subject to local sales tax.)

Part 3 — Residual petroleum product

I certify that all (100%) of the residual petroleum product covered by this certificate is being delivered to the manufacturing site for use

directly and exclusively in the production of tangible personal property for sale, by manufacturing, processing, or assembly, and will not

be consumed on the public highways of this state. (This sale is exempt from the petroleum business tax and the New York State and local

sales taxes.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2