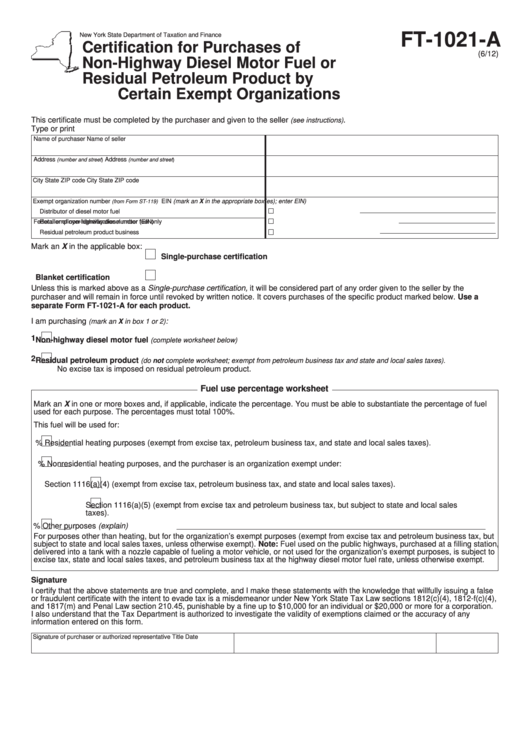

Form Ft-1021-A - Certification For Purchases Of Non-Highway Diesel Motor Fuel Or Residual Petroleum Product By Certain Exempt Organizations

ADVERTISEMENT

FT‑1021‑A

New York State Department of Taxation and Finance

Certification for Purchases of

(6/12)

Non‑Highway Diesel Motor Fuel or

Residual Petroleum Product by

Certain Exempt Organizations

This certificate must be completed by the purchaser and given to the seller

.

(see instructions)

Type or print

Name of purchaser

Name of seller

Address

Address

(number and street)

(number and street)

City

State

ZIP code

City

State

ZIP code

Exempt organization number

EIN (mark an X in the appropriate box(es); enter EIN)

(from Form ST-119)

Distributor of diesel motor fuel

Federal employer identification number (EIN)

Retailer of non-highway diesel motor fuel only

Residual petroleum product business

Mark an X in the applicable box:

Single‑purchase certification

Blanket certification

Unless this is marked above as a Single-purchase certification, it will be considered part of any order given to the seller by the

purchaser and will remain in force until revoked by written notice. It covers purchases of the specific product marked below. Use a

separate Form FT‑1021‑A for each product.

I am purchasing

:

(mark an X in box 1 or 2)

1

Non‑highway diesel motor fuel

(complete worksheet below)

2

Residual petroleum product

(do not complete worksheet; exempt from petroleum business tax and state and local sales taxes).

No excise tax is imposed on residual petroleum product.

Fuel use percentage worksheet

Mark an X in one or more boxes and, if applicable, indicate the percentage. You must be able to substantiate the percentage of fuel

used for each purpose. The percentages must total 100%.

This fuel will be used for:

% Residential heating purposes (exempt from excise tax, petroleum business tax, and state and local sales taxes).

% Nonresidential heating purposes, and the purchaser is an organization exempt under:

Section 1116(a)(4) (exempt from excise tax, petroleum business tax, and state and local sales taxes).

Section 1116(a)(5) (exempt from excise tax and petroleum business tax, but subject to state and local sales

taxes).

% Other purposes (explain)

For purposes other than heating, but for the organization’s exempt purposes (exempt from excise tax and petroleum business tax, but

subject to state and local sales taxes, unless otherwise exempt). Note: Fuel used on the public highways, purchased at a filling station,

delivered into a tank with a nozzle capable of fueling a motor vehicle, or not used for the organization’s exempt purposes, is subject to

excise tax, state and local sales taxes, and petroleum business tax at the highway diesel motor fuel rate, unless otherwise exempt.

Signature

I certify that the above statements are true and complete, and I make these statements with the knowledge that willfully issuing a false

or fraudulent certificate with the intent to evade tax is a misdemeanor under New York State Tax Law sections 1812(c)(4), 1812-f(c)(4),

and 1817(m) and Penal Law section 210.45, punishable by a fine up to $10,000 for an individual or $20,000 or more for a corporation.

I also understand that the Tax Department is authorized to investigate the validity of exemptions claimed or the accuracy of any

information entered on this form.

Signature of purchaser or authorized representative

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2