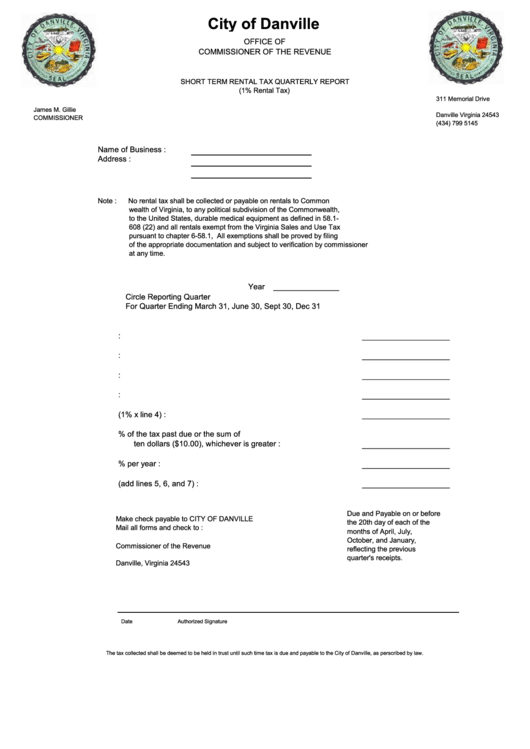

Short Term Rental Tax Quarterly Report (1% Rental Tax) Form

ADVERTISEMENT

City of Danville

OFFICE OF

COMMISSIONER OF THE REVENUE

SHORT TERM RENTAL TAX QUARTERLY REPORT

(1% Rental Tax)

311 Memorial Drive

P.O. Box 480

James M. Gillie

Danville Virginia 24543

COMMISSIONER

(434) 799 5145

Name of Business :

Address :

Note :

No rental tax shall be collected or payable on rentals to Common

wealth of Virginia, to any political subdivision of the Commonwealth,

to the United States, durable medical equipment as defined in 58.1-

608 (22) and all rentals exempt from the Virginia Sales and Use Tax

pursuant to chapter 6-58.1, All exemptions shall be proved by filing

of the appropriate documentation and subject to verification by commissioner

at any time.

Year

_______________

Circle Reporting Quarter

For Quarter Ending March 31, June 30, Sept 30, Dec 31

1.

Total gross receipts from rentals of 92 days or less :

____________________

2.

Total gross receipts from all rentals :

____________________

3.

Total exempt rentals :

____________________

4.

Total gross taxable rentals :

____________________

5.

Total tax due (1% x line 4) :

____________________

6.

Late penalty 10% of the tax past due or the sum of

ten dollars ($10.00), whichever is greater :

____________________

7.

Interest on late payments of any taxes due 10% per year :

____________________

8.

Total tax due (add lines 5, 6, and 7) :

____________________

Due and Payable on or before

Make check payable to CITY OF DANVILLE

the 20th day of each of the

Mail all forms and check to :

months of April, July,

October, and January,

Commissioner of the Revenue

reflecting the previous

P.O. Box 480

quarter's receipts.

Danville, Virginia 24543

Date

Authorized Signature

The tax collected shall be deemed to be held in trust until such time tax is due and payable to the City of Danville, as perscribed by law.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1