*141711200*

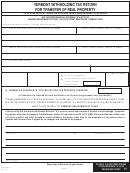

REW - SCHEDULE A

FILE ORIGINAL ONLY. DO NOT COPY. ATTACH TO RW-171, Page 1

* 1 4 1 7 1 1 2 0 0 *

PLEASE TYPE OR PRINT CLEARLY. USE BLUE OR BLACK INK ONLY.

TO BE COMPLETED BY THE BUYER OR OTHER TRANSFEREE REQUIRED TO WITHHOLD

1. The SELLER is identified by (check one only)

Social Security Number (SSN)

Federal Employer Identification Number (FEIN or FID)

c

c

2. Taxpayer’s Last Name (Enter only if using SSN)

First Name

Initial

Social Security Number

Spouses’s Last Name

First Name

Initial

Social Security Number

3. Business Entity name (Enter only if using FEIN or FID)

FEIN or FID

4. Mailing Address (Number and Street or Road Name)

5. City

State

ZIP Code

6. Foreign Country (if not United States)

7. Location and description of property

8. Date property acquired by seller (MMDDYYYY)

9. Date of transfer (MMDDYYYY)

10. Total consideration

.

12. Amount withheld for this seller

.

.

%

11. Percentage of total gross proceeds received by this seller

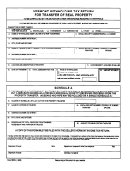

LINE-BY-LINE INSTRUCTIONS

(Use Blue or Black Ink Only)

If there are multiple sellers, the buyer must fill out a separate Schedule A for each individual or entity receiving proceeds from the

property transfer. Husband and wife may be included on a single Schedule A.

Line 1

All individual owners or entity owners receiving proceeds from the sale that use a Social Security Number to

identify themselves should check the “Social Security Number (SSN)” checkbox. All entities receiving proceeds

from the sale that use a Federal Identification Number to identify themselves should check the “Federal Employer

Identification Number (FEIN or FID)” checkbox.

Lines 2-6

Enter the Social Security Number or Federal Identification Number, name, and address of the individual or entity.

Line 7

Enter the location of the property, including town and street address.

Line 8

Enter the date the property was acquired by the seller.

Line 9

Enter the date of this transfer.

Line 10

Enter the total contract sales price from Line 12, page 1.

Line 11

Enter the percentage of the total proceeds from the property transfer that was received by this particular individual

or entity. The percentages reported for all Schedule A’s must add up to 100%.

Line 12

Enter the amount of tax withheld on behalf of this taxpayer. NOTE: The amount of tax withheld on behalf of each

seller should be in proportion to that seller’s share of the proceeds as reported on Line 11. If a seller claims a real

estate withholding amount that is not proportionate to that seller’s share of the proceeds, please provide supporting

documentation.

DO NOT COPY. For additional Schedule A’s, call (802) 828-2515.

Form RW-171

Page 2

5454

(Rev. 10/14)

Clear ALL fields

Important Printing Instructions

Print

Clear Sch. A ONLY

1

1 2

2