Form P.r - 2 - Reconciliation Of Returns Of Burmingham Occupational Tax Witheld From Wages With Witholding Statements Form - City Of Burmingham - Alabama

ADVERTISEMENT

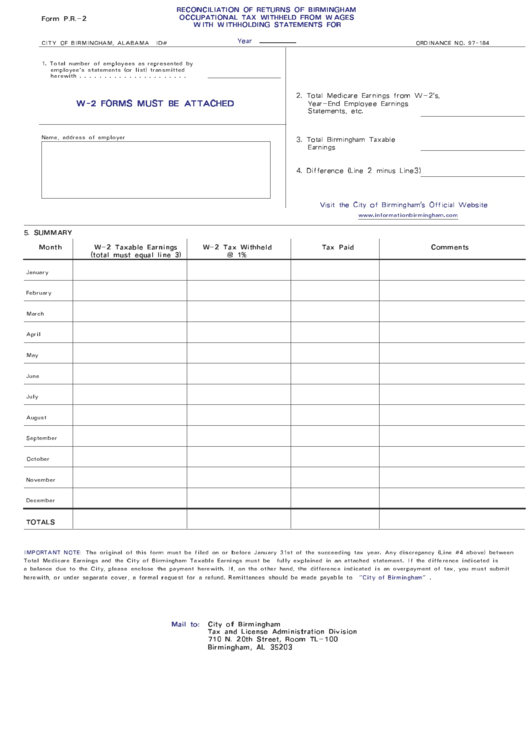

RECONCILIATION OF RETURNS OF BIRMINGHAM

OCCUPATIONAL TAX WITHHELD FROM W AGES

Form P.R.−2

W ITH W ITHHOLDING STATEMENTS FOR

Year

CITY OF BIRMINGHAM, ALABAMA ID#

ORDINANCE NO. 97−184

1. Total number of employees as represented by

employee's statements (or list) transmitted

herewith . . . . . . . . . . . . . . . . . . . . . .

2. Total Medicare Earnings from W−2's,

W−2 FORMS MUST BE ATTACHED

Year−End Employee Earnings

Statements, etc.

Name, address of employer

3. Total Birmingham Taxable

Earnings

4. Difference (Line 2 minus Line3)

Visit the City of Birmingham's Official Website

5. SUMMARY

Month

W−2 Taxable Earnings

W−2 Tax Withheld

Tax Paid

Comments

(total must equal line 3)

@ 1%

January

February

March

April

May

June

July

August

September

October

November

December

TOTALS

IMPORTANT NOTE:

The original of this form must be filed on or before January 31st of the succeeding tax year. Any discrepancy (Line #4 above) between

Total Medicare Earnings and the City of Birmingham Taxable Earnings must be fully explained in an attached statement. If the difference indicated is

a balance due to the City, please enclose the payment herewith. If, on the other hand, the difference indicated is an overpayment of tax, you must submit

herewith, or under separate cover, a formal request for a refund. Remittances should be made payable to

"City of Birmingham"

.

Mail to:

City of Birmingham

Tax and License Administration Division

710 N. 20th Street, Room TL−100

Birmingham, AL 35203

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1