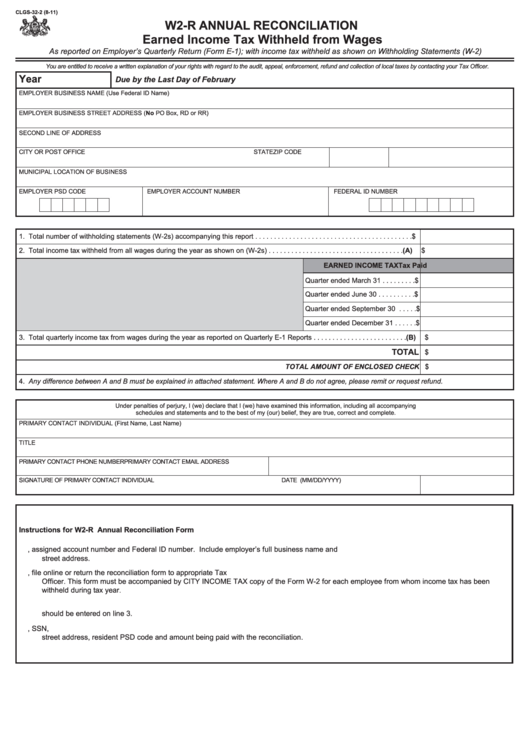

CLGS-32-2 (8-11)

W2-R ANNUAL RECONCILIATION

Earned Income Tax Withheld from Wages

As reported on Employer’s Quarterly Return (Form E-1); with income tax withheld as shown on Withholding Statements (W-2)

You are entitled to receive a written explanation of your rights with regard to the audit, appeal, enforcement, refund and collection of local taxes by contacting your Tax Officer.

Due by the Last Day of February

Year

EMPLOYER BUSINESS NAME (Use Federal ID Name)

EMPLOYER BUSINESS STREET ADDRESS (No PO Box, RD or RR)

SECOND LINE OF ADDRESS

CITY OR POST OFFICE

STATE

ZIP CODE

MUNICIPAL LOCATION OF BUSINESS

EMPLOYER PSD CODE

EMPLOYER ACCOUNT NUMBER

FEDERAL ID NUMBER

1. Total number of withholding statements (W-2s) accompanying this report . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

2. Total income tax withheld from all wages during the year as shown on (W-2s) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .(A)

$

EARNED INCOME TAX

Tax Paid

Quarter ended March 31 . . . . . . . . .

$

Quarter ended June 30 . . . . . . . . . .

$

Quarter ended September 30 . . . . .

$

Quarter ended December 31 . . . . . .

$

3. Total quarterly income tax from wages during the year as reported on Quarterly E-1 Reports . . . . . . . . . . . . . . . . . . . . . . . . .(B)

$

TOTAL

$

TOTAL AMOUNT OF ENCLOSED CHECK $

4. Any difference between A and B must be explained in attached statement. Where A and B do not agree, please remit or request refund.

Under penalties of perjury, I (we) declare that I (we) have examined this information, including all accompanying

schedules and statements and to the best of my (our) belief, they are true, correct and complete.

PRIMARY CONTACT INDIVIDUAL (First Name, Last Name)

TITLE

PRIMARY CONTACT PHONE NUMBER

PRIMARY CONTACT EMAIL ADDRESS

SIGNATURE OF PRIMARY CONTACT INDIVIDUAL

DATE (MM/DD/YYYY)

Instructions for W2-R Annual Reconciliation Form

1.

Include municipal location of business in PA, assigned account number and Federal ID number. Include employer’s full business name and

street address.

2.

On or before the last day of February following the close of the calendar year, file online or return the reconciliation form to appropriate Tax

Officer. This form must be accompanied by CITY INCOME TAX copy of the Form W-2 for each employee from whom income tax has been

withheld during tax year.

3.

The total of all income tax withheld as reflected on W-2s should be entered on line 2. Total earned income tax as reported on a quarterly basis

should be entered on line 3.

4.

Please remit any additional monies owed when filing the reconciliation. Attach statement of explanation and include the employee name, SSN,

street address, resident PSD code and amount being paid with the reconciliation.

1

1