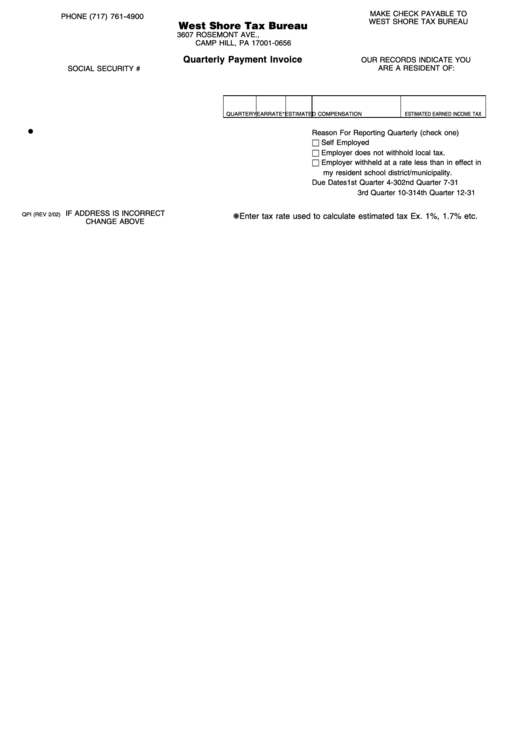

Quarterly Payment Invoice Form

ADVERTISEMENT

MAKE CHECK PAYABLE TO

PHONE (717) 761-4900

WEST SHORE TAX BUREAU

West Shore Tax Bureau

3607 ROSEMONT AVE., P.O. BOX 656

CAMP HILL, PA 17001-0656

Quarterly Payment Invoice

OUR RECORDS INDICATE YOU

ARE A RESIDENT OF:

SOCIAL SECURITY #

QUARTER

YEAR

RATE*

ESTIMATED COMPENSATION

ESTIMATED EARNED INCOME TAX

•

Reason For Reporting Quarterly (check one)

□ Self Employed

□ Employer does not withhold local tax.

□ Employer withheld at a rate less than in effect in

my resident school district/municipality.

Due Dates

1st Quarter 4-30

2nd Quarter 7-31

3rd Quarter 10-31 4th Quarter 12-31

IF ADDRESS IS INCORRECT

❋Enter tax rate used to calculate estimated tax Ex. 1%, 1.7% etc.

QPI (REV 2/02)

CHANGE ABOVE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1