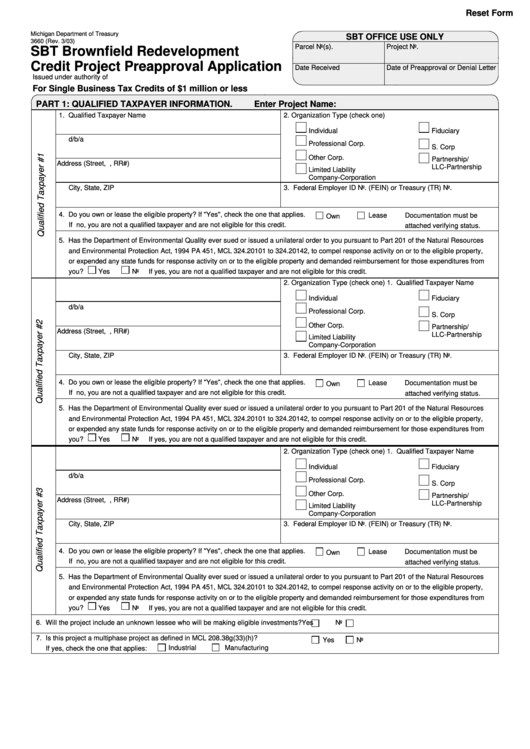

Reset Form

Michigan Department of Treasury

SBT OFFICE USE ONLY

3660 (Rev. 3/03)

Parcel No(s).

Project No.

SBT Brownfield Redevelopment

Credit Project Preapproval Application

Date Received

Date of Preapproval or Denial Letter

Issued under authority of P.A. 228 of 1975 as amended. Filing is Mandatory.

For Single Business Tax Credits of $1 million or less

PART 1: QUALIFIED TAXPAYER INFORMATION.

Enter Project Name:

1. Qualified Taxpayer Name

2. Organization Type (check one)

Individual

Fiduciary

d/b/a

Professional Corp.

S. Corp

Other Corp.

Partnership/

Address (Street, P.O. Box, RR#)

LLC-Partnership

Limited Liability

Company-Corporation

City, State, ZIP

3. Federal Employer ID No. (FEIN) or Treasury (TR) No.

4. Do you own or lease the eligible property? If "Yes", check the one that applies.

Lease

Documentation must be

Own

If no, you are not a qualified taxpayer and are not eligible for this credit.

attached verifying status.

5. Has the Department of Environmental Quality ever sued or issued a unilateral order to you pursuant to Part 201 of the Natural Resources

and Environmental Protection Act, 1994 PA 451, MCL 324.20101 to 324.20142, to compel response activity on or to the eligible property,

or expended any state funds for response activity on or to the eligible property and demanded reimbursement for those expenditures from

you?

Yes

No

If yes, you are not a qualified taxpayer and are not eligible for this credit.

1. Qualified Taxpayer Name

2. Organization Type (check one)

Individual

Fiduciary

d/b/a

Professional Corp.

S. Corp

Other Corp.

Partnership/

Address (Street, P.O. Box, RR#)

LLC-Partnership

Limited Liability

Company-Corporation

City, State, ZIP

3. Federal Employer ID No. (FEIN) or Treasury (TR) No.

4. Do you own or lease the eligible property? If "Yes", check the one that applies.

Lease

Documentation must be

Own

If no, you are not a qualified taxpayer and are not eligible for this credit.

attached verifying status.

5. Has the Department of Environmental Quality ever sued or issued a unilateral order to you pursuant to Part 201 of the Natural Resources

and Environmental Protection Act, 1994 PA 451, MCL 324.20101 to 324.20142, to compel response activity on or to the eligible property,

or expended any state funds for response activity on or to the eligible property and demanded reimbursement for those expenditures from

you?

Yes

No

If yes, you are not a qualified taxpayer and are not eligible for this credit.

1. Qualified Taxpayer Name

2. Organization Type (check one)

Individual

Fiduciary

d/b/a

Professional Corp.

S. Corp

Other Corp.

Partnership/

Address (Street, P.O. Box, RR#)

LLC-Partnership

Limited Liability

Company-Corporation

City, State, ZIP

3. Federal Employer ID No. (FEIN) or Treasury (TR) No.

4. Do you own or lease the eligible property? If "Yes", check the one that applies.

Lease

Documentation must be

Own

If no, you are not a qualified taxpayer and are not eligible for this credit.

attached verifying status.

5. Has the Department of Environmental Quality ever sued or issued a unilateral order to you pursuant to Part 201 of the Natural Resources

and Environmental Protection Act, 1994 PA 451, MCL 324.20101 to 324.20142, to compel response activity on or to the eligible property,

or expended any state funds for response activity on or to the eligible property and demanded reimbursement for those expenditures from

you?

Yes

No

If yes, you are not a qualified taxpayer and are not eligible for this credit.

6. Will the project include an unknown lessee who will be making eligible investments?

Yes

No

7. Is this project a multiphase project as defined in MCL 208.38g(33)(h)?

Yes

No

Industrial

Manufacturing

If yes, check the one that applies:

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8