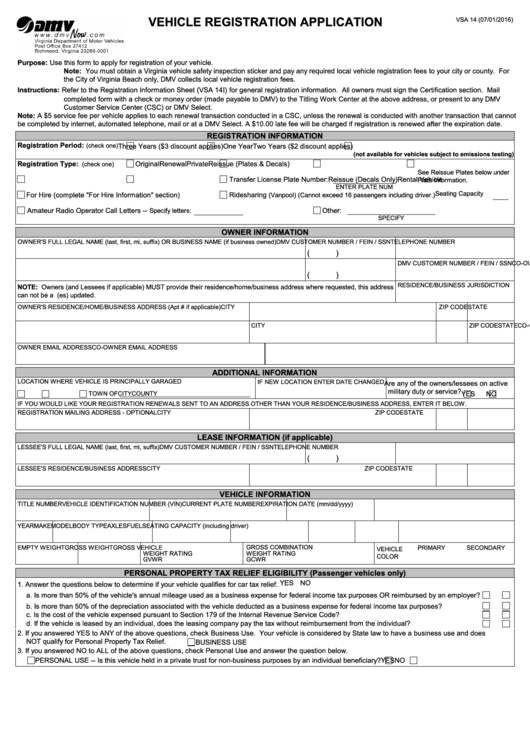

VEHICLE REGISTRATION APPLICATION

VSA 14 (07/01/2016)

Purpose:

Use this form to apply for registration of your vehicle.

Note: You must obtain a Virginia vehicle safety inspection sticker and pay any required local vehicle registration fees to your city or county. For

the City of Virginia Beach only, DMV collects local vehicle registration fees.

Instructions: Refer to the Registration Information Sheet (VSA 14I) for general registration information. All owners must sign the Certification section. Mail

completed form with a check or money order (made payable to DMV) to the Titling Work Center at the above address, or present to any DMV

Customer Service Center (CSC) or DMV Select.

Note: A $5 service fee per vehicle applies to each renewal transaction conducted in a CSC, unless the renewal is conducted with another transaction that cannot

be completed by internet, automated telephone, mail or at a DMV Select. A $10.00 late fee will be charged if registration is renewed after the expiration date.

REGISTRATION INFORMATION

Registration Period:

(check one)

One Year

Two Years ($2 discount applies)

Three Years ($3 discount applies)

(not available for vehicles subject to emissions testing)

Registration Type:

Original

Renewal

Private

Reissue (Plates & Decals)

(check one)

See Reissue Plates below under

Reissue (Decals Only)

Rental Vehicle

Transfer License Plate Number:

Plate Information.

ENTER PLATE NUM

(Vanpool) (Cannot exceed 16 passengers including driver.) Seating Capacity

For Hire (complete "For Hire Information" section)

Ridesharing

Amateur Radio Operator Call Letters --

Other:

Specify letters:

SPECIFY

OWNER INFORMATION

OWNER'S FULL LEGAL NAME (last, first, mi, suffix) OR BUSINESS NAME (if business owned)

TELEPHONE NUMBER

DMV CUSTOMER NUMBER / FEIN / SSN

(

)

CO-OWNER'S FULL LEGAL NAME (last, first, mi, suffix)

TELEPHONE NUMBER

DMV CUSTOMER NUMBER / FEIN / SSN

(

)

RESIDENCE/BUSINESS JURISDICTION

NOTE: Owners (and Lessees if applicable) MUST provide their residence/home/business address where requested, this address

can not be a P.O. Box. You must complete form ISD-01 if you would like your address(es) updated.

OWNER'S RESIDENCE/HOME/BUSINESS ADDRESS (Apt # if applicable)

CITY

STATE

ZIP CODE

CO-OWNER'S RESIDENCE/HOME/BUSINESS ADDRESS (Apt # if applicable)

CITY

STATE

ZIP CODE

OWNER EMAIL ADDRESS

CO-OWNER EMAIL ADDRESS

ADDITIONAL INFORMATION

LOCATION WHERE VEHICLE IS PRINCIPALLY GARAGED

IF NEW LOCATION ENTER DATE CHANGED

Are any of the owners/lessees on active

military duty or service?

CITY

COUNTY

TOWN OF

YES

NO

IF YOU WOULD LIKE YOUR REGISTRATION RENEWALS SENT TO AN ADDRESS OTHER THAN YOUR RESIDENCE/BUSINESS ADDRESS, ENTER IT BELOW.

REGISTRATION MAILING ADDRESS - OPTIONAL

CITY

STATE

ZIP CODE

LEASE INFORMATION (if applicable)

LESSEE'S FULL LEGAL NAME (last, first, mi, suffix)

TELEPHONE NUMBER

DMV CUSTOMER NUMBER / FEIN / SSN

(

)

LESSEE'S RESIDENCE/BUSINESS ADDRESS

CITY

STATE

ZIP CODE

VEHICLE INFORMATION

TITLE NUMBER

VEHICLE IDENTIFICATION NUMBER (VIN)

CURRENT PLATE NUMBER

EXPIRATION DATE (mm/dd/yyyy)

YEAR

MAKE

MODEL

BODY TYPE

AXLES

FUEL

SEATING CAPACITY (including driver)

EMPTY WEIGHT

GROSS WEIGHT

GROSS VEHICLE

GROSS COMBINATION

PRIMARY

SECONDARY

VEHICLE

WEIGHT RATING

WEIGHT RATING

COLOR

GVWR

GCWR

PERSONAL PROPERTY TAX RELIEF ELIGIBILITY (Passenger vehicles only)

YES NO

1. Answer the questions below to determine if your vehicle qualifies for car tax relief.

a. Is more than 50% of the vehicle's annual mileage used as a business expense for federal income tax purposes OR reimbursed by an employer?

b. Is more than 50% of the depreciation associated with the vehicle deducted as a business expense for federal income tax purposes?

c. Is the cost of the vehicle expensed pursuant to Section 179 of the Internal Revenue Service Code?

d. If the vehicle is leased by an individual, does the leasing company pay the tax without reimbursement from the individual?

2. If you answered YES to ANY of the above questions, check Business Use. Your vehicle is considered by State law to have a business use and does

NOT qualify for Personal Property Tax Relief.

BUSINESS USE

3. If you answered NO to ALL of the above questions, check Personal Use and answer the question below.

PERSONAL USE -- Is this vehicle held in a private trust for non-business purposes by an individual beneficiary?

YES

NO

1

1 2

2