Defi nition of a Mobile Home

A mobile home is defi ned as a single or multi-sectional structure which is built on a permanent chassis and is

either attached to utility services or is 27 feet or more in length. The structure must ordinarily be designed for

human living quarters, either on a temporary or permanent basis, and owned or used as a residence or place of

business by the owner or occupant. “Mobile home” also includes a manufactured home as defi ned in North

Dakota Century Code Section 41-09-02 other than a manufactured home converted to real property according to

N.D.C.C. § 39-05-35(1-3). “Utility services” means services purchased by the occupant from a utility company

under the jurisdiction of the public service commission, a rural electric cooperative, or a political subdivision of

the state.

Taxation of Mobile Homes - Exemptions

Certain manufactured housing may be exempt from mobile home taxation. Mobile home owners should check

with the County Director of Tax Equalization in the county where the mobile home is located to determine the

tax status of the mobile home. A mobile home may be exempt from taxation if the mobile home is:

1. Owned and used as living quarters of a military person on active military duty in this state who is a

resident of another state.

2. Owned and occupied by a welfare recipient, provided the mobile home is not permanently attached to the

land and classifi ed as real property.

3. Owned and used as living quarters by a disabled veteran or unremarried surviving spouse as provided in

N.D.C.C. § 57-02-08(20).

4. Owned and used as living quarters by a permanently and totally disabled person or unremarried surviving

spouse as provided in N.D.C.C. § 57-02-08(20).

5. Owned and used as living quarters for a blind person as provided in N.D.C.C. § 57-02-08(22).

6. Owned and used as living quarters by a person who qualifi es for the homestead credit as provided in

N.D.C.C. § 57-02-08.1.

7. Used only for temporary living quarters of the owner or occupant while engaged in recreational or vacation

activities, provided that the unit displays a current travel trailer license or is defi ned as a park model trailer

located in a trailer park or campground and the owner has paid a park model trailer fee as provided in

N.D.C.C. § 39-18-03.1.

8. A farm residence as provided in N.D.C.C. § 57-02-08(15).

9. Permanently attached to a foundation and assessed as real property.

10. Owned by a licensed mobile home dealer while held for resale and not used as a residence or for

conducting business.

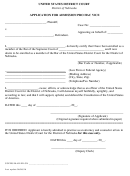

The owner who claims exemption from mobile home taxation must fi le an application for Mobile Home County

Registration with the County Director of Taxation and provide the necessary evidence to support the claim.

1

1 2

2