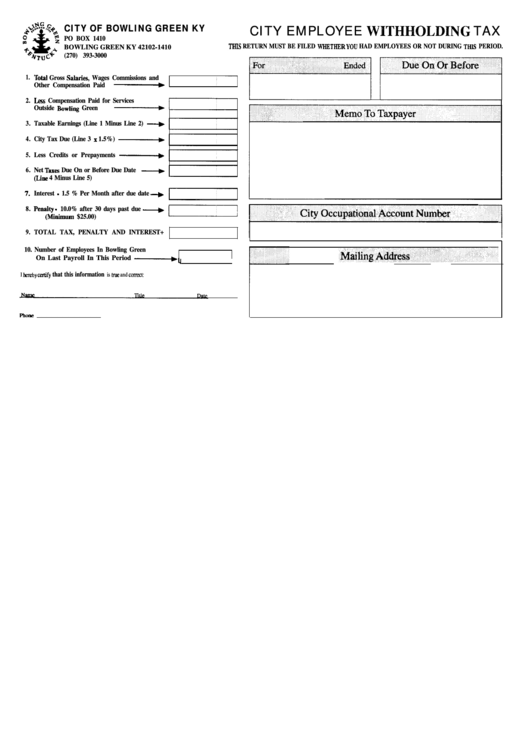

City Employee Withmqlding Tax Form - State Of Kentucky

ADVERTISEMENT

TBIS RETURN MUST BE FILED WHETBERYOU HAD EMPLOYEES OR NOT DURING TIIIS PERIOD.

I.

Total Gross SaIaries, Wages Commissions and

_I___)

Less Compensation Paid for Services

-B

(Line 4 Minus Line 5)

PenaIty - 10.0% after 30 days past due +

(Minimnm $25.00)

L 1

hereby cenify that this information

CITY EMPLOYEE WITHMQLDING TAX

CITY OF BOWLING GREEN KY

PO BOX 1410

BOWLING GREEN KY 42102-1410

(270) 393-3000

1.

Other Compensation Paid

2.

Outside Bowling Green

3.

Taxable Earnings (Line 1 Minus Line 2) -_)

4.

City Tax Due (Line 3 x 1.5%) -b

5.

Less Credits or Prepayments -b

6.

Net Tases Due On or Before Due Date +

Interest - 1.5 % Per Month after due date +

8.

9.

TOTAL TAX, PENALTY AND INTEREST+

10. Number of Employees In Bowling Green

On Last Payroll In This Period ____)

I

is true and correct:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1