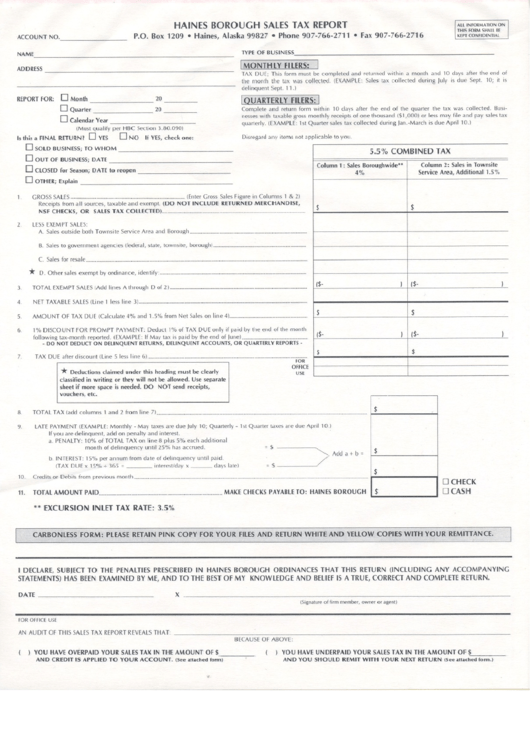

Sales Tax Report Form - Haines Borough

ADVERTISEMENT

ACCOUNT

NO.

HAINES BOROUGH SALESTAX REPORT

P.O. Box 1209

. Haines,Alaska 99827 . Phone907-766-2711 . Fax 907-766-2716

ALL INFORMATION

ON

THIS FORM SHALL BE

KEPT CONFIDENTIAL

NAME

TYPE OF BUSINESS

ADDRESS

TAX DUE; This

form must

be completed and returned within a month and 10 days after the end of

the month the tax was collected.

(EXAMPLE: Sales tax collected

during July is due Sept. 10; it is

delinquent Sept. 11.)

,

REPORT FOR:

D

Month

D

Quarter

D

Calendar Year

(Must qualify per HBC Section 3.80.090)

Is this a FINAL RETURN? DYES

D

NO

If YES, check one:

D

SOLD BUSINESS; TO WHOM

D

OUT OF BUSINESS; DATE..

D

ClOSED for Season; DATE to reopen

D

OTHER; Explain

20

20

Complete and return form within

10 days after the end of the quarter the tax was collected.

Busi-

nesses with taxable gross monthly receipts of one thousand ($1,000) or less may file and pay sales tax

quarterly. (EXAMPLE: 1st Quarter sales tax collected during Jan.-March is due April 10.)

Disregard any items not applicable to you.

1.

GROSS SALES

(Enter Gross Sales Figure in Columns 1 & 2)

Receipts from all sources, taxable and exempt. (DO NOT INCLUDE

RETURNED MERCHANDISE,

NSF CHECKS, OR

SALES TAX COLLECTED)..............................................................................................................

2.

LESS

EXEMPT SALES:

A. Sales

outside both Townsite Service Area

and Borough ..........................................................................................

B.

Sales to government agencies (federal, state, townsite, borough).......................................................................

C. Sa les for resa Ie .........................................................................................................................................................................

*

D. Other sales exempt by ordinance,

identify: ................................................................................................................

3.

TOTAL EXEMPT SALES

(Add lines A through D of 2)

;.............................................

4.

NET TAXABLESALES (Line 1 less line 3)

".....................

S.

AMOUNT OF TAX DUE (Calculate 4% and 1.5% from Net Sales on line 4)............................................................

6.

1% DISCOUNT FOR PROMPT PAYMENT:Deduct 1% of TAX DUE only if paid by the end of the month

followingtax-monthreported.(EXAMPLE: IfMaytax is paid by the end of

June)...................................................

- DO NOTDEDUCT ON DELINQUENT RETURNS, DELINQUENT ACCOUNTS, ORQUARTERLY REPORTS.

7.

TAXDUEafterdiscount(line 5 less

line 6)..........................................................................................................................

FOR

*

Deductions claimed under this heading must be clearly

O~F~~E

classified in writing or they will not be allowed. Use separate

sheet if more space is needed. DO NOT send receipts,

vouchers, etc.

8.

TOTALTAX(add columns 1 and 2 from line

7).................................................................................................................................................................

$

9.

LATE PAYMENT (EXAMPLE:

Monthly - May taxes are due July 10; Quarterly.. 1st Quarter taxes are due April 10.)

If you are delinquent,

add on penalty

and interest.

a. PENALTY: 10% of TOTAL TAX on line 8 plus 5% each additional

month of delinquency until 25% has accrued.

=

$

"""

"'"

Add a + b

=

b.

INTEREST: 15% per annum from date of delinquency

until paid.

..""

(TAX DUE x 15%"," 365

=-

interest/day

x

-

days late)

=

$

$

10.

$

Credits or Debits from previous month

'

11.

TOTAL AMOUNT PAID

MAKECHECKS

PAYABLE TO:

HAINES BOROUGH

$

0 CHECK

0 CASH

**

EXCURSION INLET TAX RATE: 3.5%

I DECLARE, SUBJECT TO THE PENALTIES PRESCRIBED IN HAINES BOROUGH

ORDINANCES

THAT THIS RETURN (INCLUDING

ANY ACCOMPANYING

STATEMENTS) HAS BEEN EXAMINED BY ME, AND TO THE BEST OF MY KNOWLEDGE

AND BELIEF IS A TRUE, CORRECT AND COMPLETE RETURN.

DATE

X

(Signature

of firm member.

owner

or agent)

FOR OFFICE USE

AN AUDIT OF THIS SALES TAX REPORT REVEALS THAT:

BECAUSE OF ABOVE:

) YOU HAVE OVERPAID

YOUR SALES TAX IN THE AMOUNT

OF $

AND CREDIT IS APPLIED TO YOUR ACCOUNT.

(See attached form)

) YOU HAVE UNDERPAID

YOUR SALES TAX IN THE AMOUNT OF

L---

AND YOU SHOULD REMIT WITH YOUR NEXTRETURN

(See attached form.)

..

5.5% COMBINED

TAX

Column 1: Sales Boroughwide**

Column 2: Sales in Townsite

4%

Service Area, Additional

1.5%

$

$

($-

)

($-

)

$

$

($-

)

($-

)

$

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1